Vietnam strives for FDI and supply chain lift

main text

Vietnam strives for FDI and supply chain lift

Manufacturing is a key driver of the economic growth of Vietnam which offers the main advantage of lower production costs to manufacturers. At the same time, attracting more foreign direct investment (FDI) plays a crucial role in the country’s external economic affairs.

As the China Plus One strategy came in over the last few years, Vietnam has become a promising alternative for manufacturing diversification to reduce geopolitical and supply chain risks. To maintain appeal and boost FDI, the Vietnamese government seeks to upgrade supply chain capabilities and infrastructure.

Will Vietnam be your next investment destination?

Industrial production down 2% in the first five months

As global demand weakened, Vietnam's exports between January and May of 2023 dropped 11.6% from previous year to US$136.17 billion, showed government data. In the first five months, the country's industrial production also fell 2% on an annual basis.

In particular, exports in smartphones, one of Vietnam's largest export earners, dropped 16% in the five-month period to US$21.17 billion.

At the same time, imports in the first five months fell 17.9% from a year earlier to US$126.37 billion, resulting in a trade surplus of US$9.8 billion. The significant decline could indicate that enterprises has reduced procurement of raw materials and equipment, which would further slow down industrial production.

Vietnam has set its GDP growth target at 6.5% this year, and although the economy would face unfavorable external conditions, Deputy Prime Minister Tran Luu Quang stated that the target will not be revised. In the first quarter, the country achieved a GDP growth of 3.3%.

Seven new logistic centers to be built in Ho Chi Minh City

By 2025, seven new logistic centers will be built in the southern economic hub of Ho Chi Minh City, Vietnam, reported VnExpress. In addition, the city will also call for investments to four of the seven centers.

Specifically, the locations include the Hi-Tech Park in Thu Duc city, Cat Lai, Long Binh, Linh Trung, Cu Chi, Hiep Phuoc, and Tan Kien.

Municipal authorities will invest in upgrading and perfecting interregional transportation linkage, including roadway, waterway, airway and railway to integrate to a project on transportation infrastructure development in the locality during 2023-2030.

Moreover, a centralized data storage will be developed to digitize transportation activities to optimize logistics network in Ho Chi Minh City and adjoining cities, says the report.

Strengthen connection with ASEAN partners

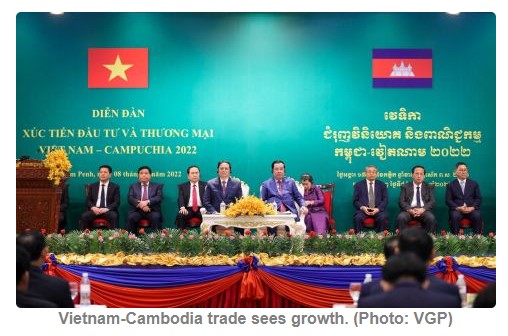

Vietnam became the largest trading partner of Cambodia among members of ASEAN between January and May 2023 as bilateral trade made up nearly 50% of the total between Cambodia and ASEAN members during the period.

During the five months, trade between the two countries reached US$2.8 billion, up rising nearly 3% from previous year. Cambodia exported about US$1.3 billion worth of goods to and imported commodities totaling over US$1.5 billion from Vietnam, said the Cambodian Ministry of Commerce.

At a business forum held by the Singapore Business Association on July 7, the National Innovation Centre (NIC) under the Vietnamese Ministry of Planning and Investment (MPI) and the National University of Singapore (NUS) signed a memorandum of understanding (MoU) on cooperation to enhance the innovation capacity in both countries.

Under the MoU, NIC and NUS will set up working groups to strengthen collaboration in innovation and connectivity of the startup ecosystems in the two countries in the next three years, VietnamPlus reported.

It is also one of the major cooperation activities of the Vietnam-Singapore Working Group on Innovation, which helps Vietnam to gradually transform to an innovation-oriented economy.

A favorable destination in China Plus One strategy

In wake of geopolitical tensions and the supply chain risks uncovered during the COVID-19 pandemic, more manufacturers consider pursuing a diversification strategy, not least looking to factories and sources of supply outside China.

The growing China Plus One strategy refers to a business approach in which enterprises to diversify their operations to alternative destinations outside China while still maintaining presence in the country.

Vietnam is one of the favorable destinations in the China Plus One strategy, thanks to its proximity to China, long coastline, younger population, lower labor cost, free trade agreements, and so on. It is also in convenient position with both the West and the East.

Space at the Deep C II industrial zone, which runs by Belgian developer, is in high demand, Financial Times reported. The industrial zone in northern Vietnam houses some of the largest suppliers to tech conglomerates such as Apple.

Dung Bui Thi Thuy, a marketing executive at Deep C, was quoted as saying “we will reclaim the land from the sea” if there is enough demand.

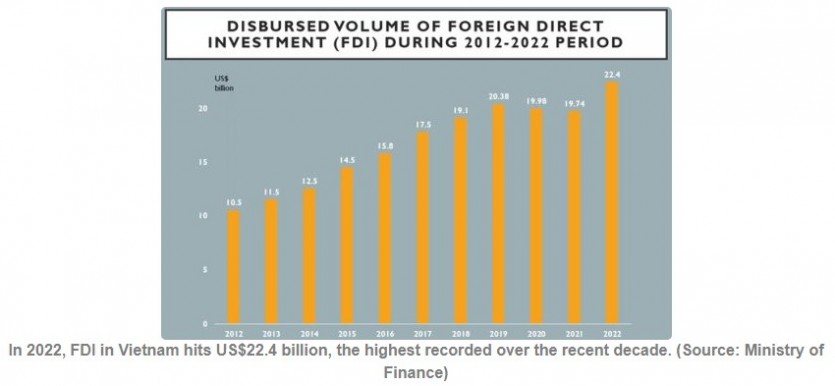

FDI in Vietnam hit decade high last year. Total disbursed volume of FDI in 2022 has reached a new record of US$22.4 billion, up 13.5% over the previous year, according to the Ministry of Planning and Investment.

Among 18 sectors attracting FDI, processing and manufacturing took the lead with US$16.8 billion, making up 60.6% of the total foreign investment inflows.

Singapore topped the list of 108 nations and territories pouring capital in Vietnam over 12 months, with US$6.46 billion, accounting for 23.3%, followed by Korea and Japan.

Although Vietnam cannot be the factory of the world now, the country can supplement manufacturers with operations in China, still the world’s biggest manufacturing hub.

Wave of Chinese investments present opportunity

In 2022, China ranked 4th with US$2.52 billion in the list of countries investing in Vietnam, following Singapore, Korea, and Japan, according to Vietnam’s Ministry of Planning and Investment. Majority of the Chinese investments were injected into the manufacturing and processing industries.

Meanwhile, Vietnam has been China’s largest trade partner in Southeast Asia since surpassing Malaysia in 2018.

According to a review report by Reuters, after China relaxing its pandemic measures, Chinese enterprises invested in 45 new projects in Vietnam during the first 50 days of 2023, the most from a single country.

The enterprises contributing to the increasing Chinese investment are mostly smaller suppliers to larger players already in the country, said industry experts cited by Reuters.

For instance, there has been an inflow of plastic molding, die casting and energy storage providers in the Vietnamese solar panel industry, which is dominated by Chinese players.

Michael Chan, Senior Director of Leasing at industrial real estate specialist BW Industrial Development, told Reuters that enquiries from Chinese enterprises about manufacturing investment in Vietnam grew exponentially in the last quarter of last year. “Chinese investment has also increased remarkably,” he said.

Chinese electronics, robotics, and home appliance manufacturers were also among top spenders on industrial leases last year, according to Do Hong Quan, Head of Vietnam Investment Consulting, whose focus is Chinese investors.

Koen Soenens, Sales Director at Deep C, told the news agency that the number of contracts his company signed with Chinese enterprises in 2022 rose steeply toward year-end.

Among new partners, he cited automotive wheels supplier Xiamen Sunrise Group Co., Ltd. and new materials supplier Hanghzou First Applied Material Co., Ltd.

Bottlenecks need to be solved for further growth

An analysis article on Vietnam Briefing commented that rather than competing, China and Vietnam are complementing each other as the latter has a less developed supply chain network, and still relies on imports of raw materials.

“Emulating China’s supply chain network will also be an expensive affair (for Vietnam) but is likely to happen in the long term,” it said. “Vietnam is also likely to follow China’s model of upgrading its economy by attracting hi-tech industries.”

However, potential investors should be aware of some bottlenecks and uncertainties in Vietnam’s road to further development, such as inadequate infrastructure, government bureaucracy, and unclear regulatory framework.

Vietnam’s bureaucratic and physical infrastructure, including the electricity grid, is straining under the weight of demand just as the country faces headwinds from a turbulent global economy, remarked the Vietnam Briefing’s article.

* Source : https://www.adsalecprj.com/web/news/article_details?id=63072&project_id=118&lang=1

* Edit : HANDLER