Waiting for normal in a volatile post-COVID economic reality

main text

Waiting for normal in a volatile post-COVID economic reality

Like many Americans, I grew up in a household in which the prevailing economic philosophy was quite simple: Make money, spend money. More is better than less, and sooner is better than later.

I have spent most of my adult life diligently studying the exquisite nuances and the intricate relationships of the Dismal Science, but I will confess the more rudimentary approach of my parents has worked pretty well for a lot of American households over the long run.

The recent pandemic caused a major disruption to this basic approach to the U.S. economy, and we are still trying to get back to some semblance of a pre-COVID normal. We are not quite there yet. Many households are still feeling the aftershocks of both the pandemic itself and the policy measures that attempted to alleviate the shock of the pandemic.

Nevertheless, we are getting closer to a version of normal. The big question now is: How much longer is this going to take?

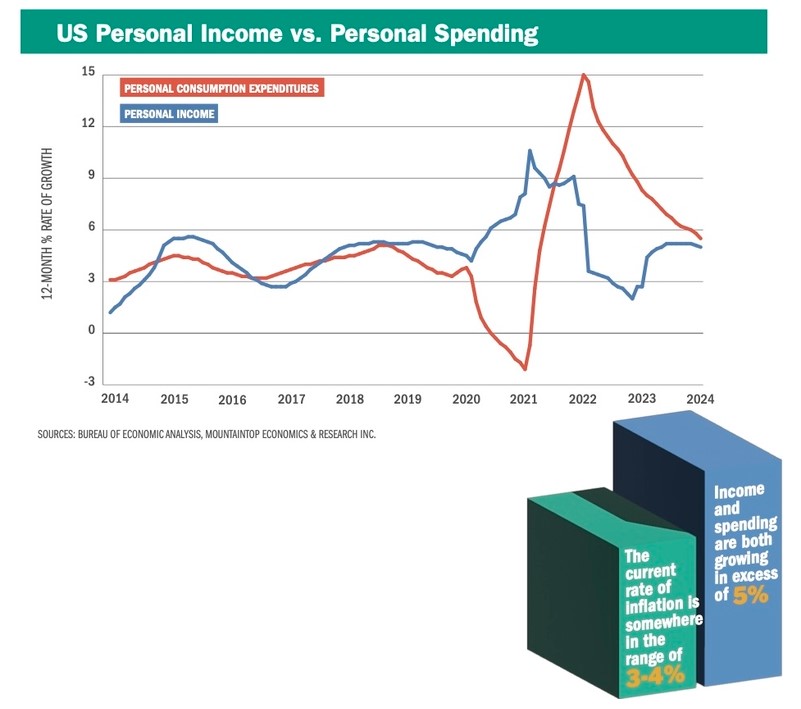

On the chart I have graphed the rate of change curves for two basic economic indicators: personal income and personal spending. These are the fundamentals. The importance and interdependence of these two indicators is so intuitively obvious that most of the time these curves are a nonstory. They usually just chug along, exhibiting steady growth in close proximity to one another. We simply tend to take for granted the whole "make money, spend money" part of our daily lives. During COVID, however, things got volatile — to put it mildly.

Because of the shutdown in 2020, the U.S. economy entered into a brief, overall recession. This is when the personal spending curve dipped below the zero line on the chart. At the time, nobody in the federal government knew how long the recession would last, or how grand the subsequent recovery would be. So they decided to throw a lot of liquidity into the system and hope for the best.

Personal income never dipped below the zero line during the pandemic. In fact, it rose quite sharply. As we all know, this was due to the huge amount of money the federal government pumped into the economy.

In retrospect, it is safe to say the recovery blew the top off even the most optimistic of expectations. We avoided a serious recession in which Americans lost their jobs, but we are still grappling with the uncomfortable side effects of the decision to inflate the money supply.

One side effect nobody expected was the dramatic shift away from spending on goods and into spending on services. This shift has been particularly painful for many segments of the U.S. manufacturing sector, especially the plastics industry.

At the time, the pandemic was actually a boon for many plastics processors, but that all ended just after the pandemic ended. Shortly thereafter, the Fed started to hike interest rates. These two factors have combined to create a deep recession in the plastics industry.

I expect the trends to shift back toward a more traditional level of personal spending on goods in the future, but there is no evidence so far to show that this shift has started. In the meantime, we must watch to make sure the trend in total spending does not accelerate downward because that will take everyone down, both goods and services.

The graph clearly shows that personal spending has decelerated since the Fed started to raise interest rates, but the line is still well above the long-term historical average. This is too high. The main reason the rate of inflation has increased so far in 2024 and remains significantly higher than the Fed's target of 2 percent is because Americans are still spending at a robust rate.

Clearly, the spending graph is trending downward, and if the Fed has its policy dialed-in correctly, then this line will level off in the near future somewhere below the personal income curve, but above the zero line. This will mean the economy has avoided a recession and spending has slowed enough to allow prices to stabilize. That is the definition of a "soft landing."

That is the optimal scenario. One in which the curves will eventually show that income is growing faster than spending. A scenario in which spending growth consistently exceeds income growth is not sustainable in the long term. Spending growth can exceed income growth for short periods of time if households choose to either spend down their savings levels or increase their debt levels.

During the two-year period from 2020 through 2021, the level of revolving consumer loans outstanding actually declined substantially while the savings rate averaged over 13 percent per month. Since that time, however, households have aggressively spent their savings. The savings rate is currently at 3.6 percent, which is below the long-term average. At the same time, consumers have aggressively increased the levels of debt on their credit cards. The total for consumer loans on credit cards and other revolving plans jumped by 10 percent in 2023.

I would like the spending curve to drop below the income curve and stay there — forever. Ideally American households would raise their savings rate and lower their debt levels. For now, the best I can say is the income curve has plateaued at a level that is near the pre-pandemic range, and if the current trends hold, then the spending curve will get to a more sustainable level by the end of this year.

The recent data for both income and spending show these indicators are currently rising faster than the overall rate of inflation. The current rate of inflation is somewhere in the range of 3-4 percent, while income and spending are both growing in excess of 5 percent. So, most households are no longer going backward with regard to purchasing power.

But if our ultimate desire is to get back to a more normal economic condition, then we need these curves to get back to a picture that represents a more healthy and sustainable state of equilibrium. To get there, we will need a predictable and manageable rate of inflation, interest rates that are not restrictive, and a labor market that induces a rising standard of living for all Americans who are willing and able to work for it.

* Source : https://www.plasticsnews.com/news/waiting-normal-volatile-post-covid-economic-reality

* Edit : HANDLER

- PreviousMost commodity resins see hikes in March as PE stays flat 24.04.21

- NextAI a ‘game-changer' for injection molding 24.04.21