US labor market still out of balance

main text

US labor market still out of balance

Most of the time, I try to stay out of the weeds when I write this column. In fact, one of my overarching themes in this endeavor is to simplify complicated economics-based concepts and render them more palatable to those readers who are decidedly not economists.

But be forewarned, this month I am taking you on a brief foray into the taller weeds. My motivation for doing so stems from all of the recent questions and comments about the state of the labor market for plastics processors.

Many of you are still having difficulty finding qualified workers, and all of you are experiencing rapidly rising labor costs. This comes at a time when you have no ability to pass these higher costs along.

In other words, you cannot afford to lose good workers, but it is becoming so expensive that you cannot afford to keep them either. A question I often hear: "When will these pressures start to ease?" This is a difficult and complicated situation, hence the need to go a bit deeper into the data.

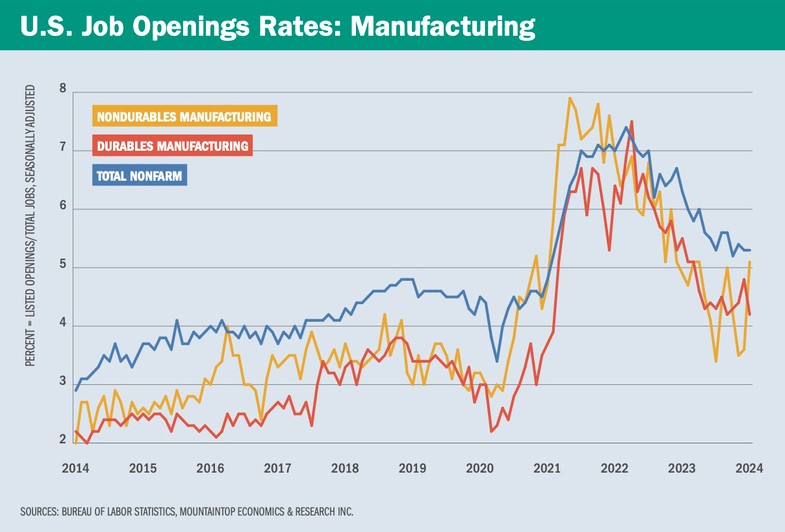

On the chart, I have graphed the monthly job openings rates for both durable goods manufacturers and nondurable goods manufacturers for the past 10 years. I have also included a line for the total U.S. nonfarm rate as a comparison. For most of our lives, this level of information about the labor market was not that important. But it is of great relevance to our current situation, so I beg your indulgence for a bit longer.

Job openings rates are calculated by taking the total number of open job listings at the end of the month and dividing this number by the total number of jobs, both filled and unfilled, in the industry at that time. For example, if there were a total of 100 jobs in the plastics industry at full employment, but five of them were presently unfilled, then the openings rate would be 5 percent. This definition is subject to interpretation, so there is a fair amount of noise in the monthly readings. But the overall trends in the data are quite instructive.

This chart is useful for our current predicament because it enables us to compare the current level of the job openings rate for manufacturing to historical levels, especially the levels pre-COVID-19. It also enables us to compare the rates for the manufacturing sector to other sectors of the economy.

As you can see, prior to the pandemic, the job opening rates for both durables and nondurables manufacturing tended to fluctuate between 2-4 percent. I wish I could say the manufacturing sector was more dynamic than that, but this narrow range was the discouraging reality for a long time.

The total U.S. economy, on average, has been more dynamic than the manufacturing sector, so that line on the chart tended to stay at a higher level. That's because growth industries typically have a higher level of job openings; it's what defines them as growth industries.

The U.S. economy is consistently the largest, most innovative and most dynamic economy in the world, but for most of the past generation, this dynamism has shown up in sectors other than manufacturing.

Obviously, the pandemic disrupted all of that, but during the past two years, the lines have trended back toward their longer-term, pre-pandemic averages. The lines representing the manufacturing sector are once again consistently below the line for the overall economy, but they all remain above the typical historical levels.

This indicates that the U.S. labor market is still out of balance; it is still too tight. In fact, there are still substantially more jobs open at the present time than there are workers to fill them. That is keeping upward pressure on labor costs. It is also putting upward pressure on the rate of overall inflation in the U.S.

Prices for almost all types of goods and services across the board are startlingly higher than they were just four years ago, and despite the Fed's recent efforts to raise interest rates, prices for many types of services are still trending higher.

When it comes to the supply of labor, U.S. manufacturers are competing not only with other manufacturers for workers but also with a lot of other sectors. In the recent economic environment, we have witnessed a significant, nationwide rise in the minimum wage. Labor unions have also enjoyed a number of high-profile victories.

And the costs of health care are skyrocketing mostly because of the large wage gains in that sector. The job openings rate for the health care industry is 7.7 percent, which is well above the national average and the manufacturing sector.

It is quite likely this strong uptrend in wages will ultimately drive the next wave of economic growth in this country. We are a nation of consumers, and when we get more income, we spend it. But we will have to endure a few more quarters of stress before we start to enjoy the coming cycle of prosperity. But I am optimistic the market will find a sustainable equilibrium.

I will conclude this tour of the deep labor market weeds by stating that it is gradually getting better. It is not getting better at a rate that will relieve the near-term stress on most manufacturers, but it is getting better. Despite all of the disruption caused by the pandemic, it turns out the absolute best cure for high prices, is still … high prices. The market is finding solutions to our problems.

The population is not growing fast enough to fill all of these jobs, manufacturing or otherwise, with workers, but innovations are coming to market daily that will render many of these jobs obsolete. Automation and artificial intelligence are already replacing workers, and in the span of just a few more years, the current labor imbalances will be relegated to history.

This will be especially true in the manufacturing sector. Few sectors will be as radically transformed by AI and automation as the manufacturing sector is going to be. U.S. manufacturing will regain its prominence as one of the most innovative and dynamic sectors in the economy, and the graph of job opening rates for manufacturers will stay consistently above the overall U.S. average. Qualified applicants for manufacturing jobs in the future will need to be highly skilled technicians.

* Source : https://www.plasticsnews.com/news/us-labor-market-still-out-balance

* Edit : HANDLER

- PreviousAI a ‘game-changer' for injection molding 24.04.21

- NextPP prices leap in February 24.03.20