Plastics machinery orders nudge up

main text

Plastics machinery orders nudge up

Plastics Industry Association

North American plastics processors made small increases in overall machinery investments in the second quarter of 2025 despite ongoing uncertainty in global trade policy.

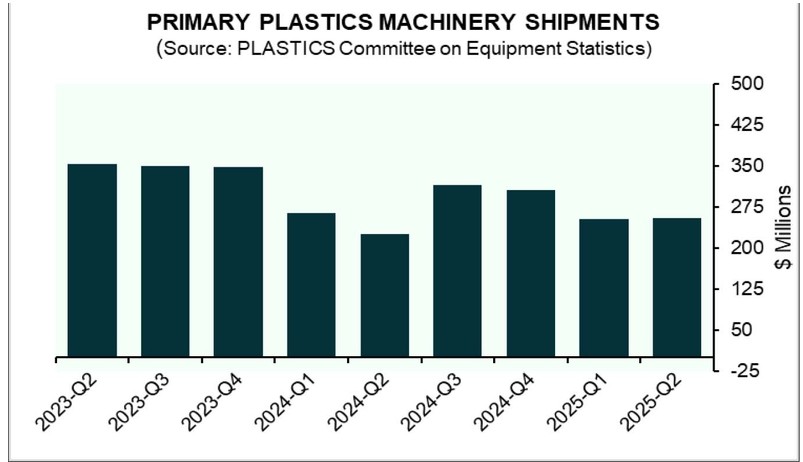

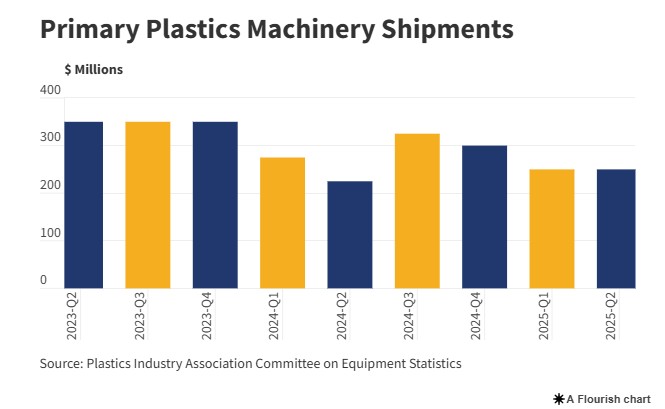

The total shipment value nudged up to $253.8 million, a 0.7 percent increase compared with both the previous quarter and the same period last year, according to a report from the Plastics Industry Association’s Committee on Equipment Statistics (CES).

"Shipments stopped falling in the second quarter. In fact, comparing the first half of 2025 to the same period in 2024, shipments increased by 3.5 percent," Perc Pineda, the association's chief economist, said in a news release. "It seems the plastics industry had a better handle on ongoing trade and tariff challenges across the value chain in the second quarter compared to the first."

The 0.7 percent increase in the shipment values of extruders and presses is slight but going in the right direction, according to Plastics News' Economics Editor Bill Wood.

"It isn't indicative of a downtrend but I wouldn't say that it means that they we have started an uptrend," Wood said. "It held steady."

The uptick in plastics machinery shipments was driven by twin-extruder shipments, which were up 48.5 percent from the first quarter and 115.4 percent from the second quarter last year.

In contrast, single-screw extruder shipments fell 11.1 percent from quarter to quarter but rose 6.5 percent year over year.

Injection molding shipments followed that same trend as single-screw extruders dropped 3.1 percent from the previous quarter but rose 5.4 percent from the second quarter of 2024.

Still, Pineda said high tariff rates remain a concern.

"If the overarching goal is to strengthen U.S. manufacturing competitiveness — a goal the plastics industry fully supports — then, in the short term, the industry should be able to import production inputs and equipment no longer made in the U.S. at lower tariff rates," Pineda said.

Wood sees some merit to the concept.

"We import far more plastics machinery than we export and that's the exact scenario [President Donald] Trump is targeting," Wood said. "There just isn't that much available in the U.S. and he is trying to turn that around. In the short term, the industry should be able to import production inputs and equipment no longer made in the U.S. at lower tariff rates."

The real effect of tariffs hasn't been felt yet because many companies absorbed them without passing along price increases, but that is expected to change.

"You still have the effect of tariffs hanging over the future performance," Wood said.

Extrusion market expectations

Twin-screw extruder shipment values were a bright spot in the second quarter.

The North American twin-screw extruders market size was estimated at $2.9 billion in 2024, and it is projected to reach $4.75 billion by 2033 with a compound annual growth rate of 5.3 percent, according to Grand View Research, a market analysis and research firm based in Ireland.

Investments for twin-screw extruders, used for mixing, compounding, pelletizing and processing, are primarily driven by applications in the automotive, packaging and construction markets, according to the Grand View Research report.

"High adoption of advanced manufacturing technologies and automation supports strong demand," the Grand View report says. "Regulatory emphasis on quality and efficiency encourages the use of precision-engineered extruders. Continuous R&D investment by major players further strengthens market leadership."

The Grand View report adds: "The Canada twin-screw extruders market is witnessing steady growth, driven by expanding pharmaceutical and packaging sectors. Increased focus on sustainable manufacturing and recycling processes is fueling demand for modern extrusion systems. Government support for industrial innovation and clean technologies also plays a key role. Imports of high-performance extruders are rising to meet evolving industry requirements."

About market conditions

As for U.S. plastics machinery trade, imports fell 7.9 percent in the second quarter but rose 1.9 percent compared to the same period last year.

Meanwhile, total exports ticked higher by 0.4 percent from the previous quarter but saw a 4.3 percent decline year over year.

Fifty-eight percent of CES members who responded to a second-quarter survey expect market conditions to remain steady or improve over the next 12 months. That's down from 62 percent in the previous quarter.

However, the number of survey respondents to report that quoting activity held steady or improved jumped from 65 percent to 76 percent.

"The advance estimate of U.S. real GDP showed a 3.0 percent increase in the second quarter, rebounding from the 0.5 percent decline in the previous quarter. This growth was largely driven by a sharp drop in imports, which are subtracted in the calculation of domestic output," Pineda said. "However, the broad-based increase in household spending — across durable goods, nondurable goods, and services — also points to room for growth in plastics manufacturing, particularly as imports decline."

* Edit : HANDLER