Assessing the US motor vehicle market amid potential tariffs

main text

Assessing the US motor vehicle market amid potential tariffs

Roger Mastroianni, General Motors

GM's Ultium Cells Warren plant celebrates the production of its 100 millionth EV battery cell.

I am a staunch defender of free markets. I say that without reservation. And after a lifetime of study, I know more than most people about the flaws in free markets. Free markets are far from perfect. But despite their obvious and confounding flaws at times, free markets remain unsurpassed at creating widespread prosperity.

Nevertheless, there are times when regulatory action is appropriate. The question is always one of when it is appropriate.

Tariffs are a form of government-imposed market manipulation. As a devout free-marketeer, I am philosophically opposed to tariffs. But my personal opinion does not matter. Unless there is a sudden change in the proposed policies, we are about to have tariffs imposed onto many of our decisions about buying and selling.

One of the main sectors of the economy that is in the middle of all of this tariff debate is the U.S. motor vehicle industry. By a wide margin, the analyses I have read so far about the effects of tariffs on the domestic motor vehicle industry have been negative. I tend to agree with this.

But putting my own skepticism about the effectiveness of tariffs aside, I must also admit that I might be wrong. I cannot predict the future. The expressed idea behind these tariffs is that they are going to help domestic manufacturers in the long run.

Depending on how the multitudes of buyers and sellers around the world react to the tariffs, it is possible the policy will work as intended. I do not think this is the most probable outcome, but I cannot rule this possibility out completely.

And rather than get derailed by a policy decision I cannot control, I will instead focus my attention on the state of the motor vehicle market at the present time. By understanding where the vehicle industry is right now, I will be in a better position to assess the positive or negative effects of the tariffs down the road.

The analysis on this industry will likely become increasingly complicated and detail-oriented the further in time we go under this new tariff policy. For now, I will start by identifying the latest trends in three of the fundamental indicators of motor vehicle demand in the U.S. These are: motor vehicle miles traveled; light vehicle sales; and motor vehicle assemblies. This is not an exhaustive list of relevant information about this bellwether industry, but if the tariffs are to have a significant impact on the industry, then I think it will show up in the trends for these indicators quickly.

The current trend in motor vehicle miles traveled is a good indicator of future demand for motor vehicles and parts. For obvious reasons, this indicator dropped precipitously during the pandemic, but it has been in an uptrend ever since. The rise was sharp in 2021, but it has gradually decelerated during the past three years.

In 2024, the total number of vehicle miles traveled increased by 1 percent when compared with the previous year. I expect the growth rate to be positive this year, but it will likely not exceed 1 percent. If we set aside the effects of any tariffs this year, this rate of growth in miles traveled would be sufficient to keep a floor under the demand for motor vehicles, but it would not be enough to generate an accelerating growth rate in demand for either new vehicles or parts this year.

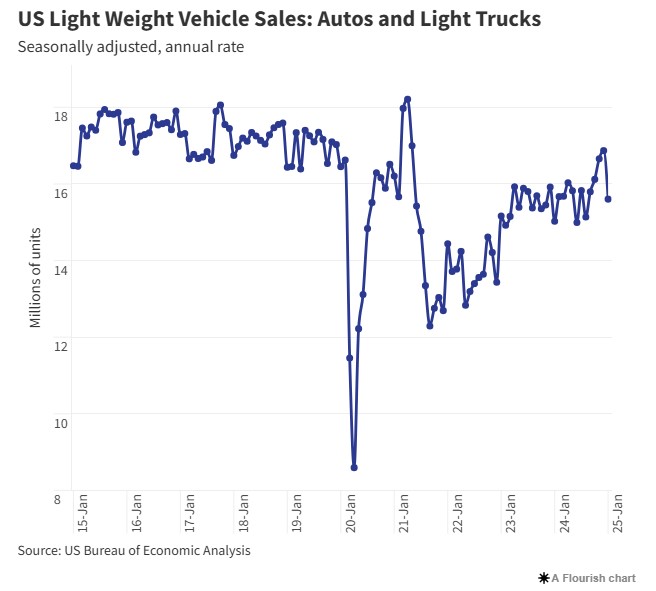

As the chart illustrates, sales of light vehicles hit a plateau in 2023 between 15 million and 16 million units. The trend then exhibited a nice surge in the second half of 2024. Unfortunately, the data from the first month of 2025 indicates a reversion back to the mean. This data is sensitive to interest rates, and the real (inflation-adjusted) interest rate has increased in the past year. So, the breakout in the second half of 2024 may have been a head fake to the upside, and the data may now start to trend downward. Keep in mind that this is before any tariffs have been enacted.

The real question now is where the data goes from here. If it stays in the recent range, then that will line up with the trend in miles traveled. In other words, there is a floor under the market, but there is no reason to expect accelerating growth. This data includes sales of both foreign and domestic vehicles, so this is where I will be looking hard for any impact resulting from tariffs.

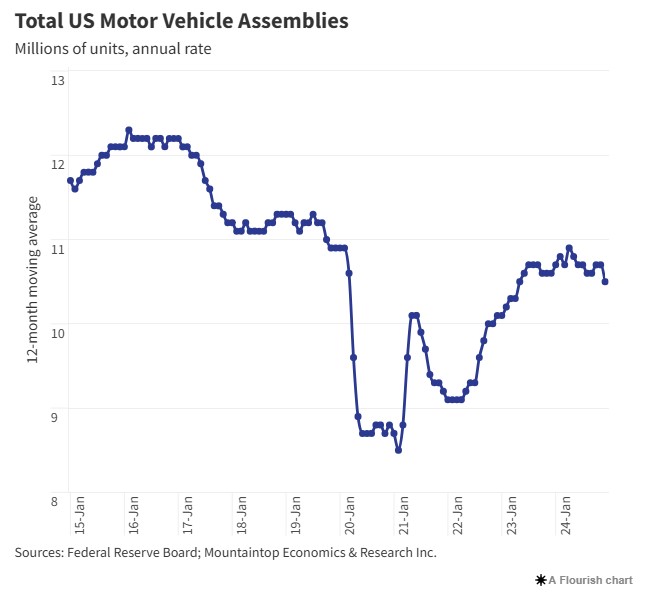

On the second chart, the trend in total motor vehicle assemblies mirrors the trend in light vehicle sales during the past couple of years, except the number of assemblies did not experience a surge in the second half of 2024. In 2024, the total number of assemblies declined by 1 percent when compared with the total from 2023. This data is in a mild downtrend, but the moving average has stayed right around the level of 10.6 million units since early 2023. Again, there are no tariffs here.

I consider the trend in the assemblies data to be a good indicator of demand for domestically produced plastic parts because it best captures the domestic output of motor vehicles. I expect the trend in this data to hold steady based on the recent trends in miles traveled and vehicle sales. That is unless there is some kind of market shakeup such as a substantial increase in the cost of new vehicles resulting from a disruptive tariff policy.

My main takeaway is that, at this moment in time, demand for motor vehicles in the U.S. is steady but not growing. My best explanation for this is that the price of vehicles appreciated substantially during the past three years, and the prevailing interest rates are also higher than what Americans paid three or four years ago. The good news is that demand has not yet collapsed due to the higher prices and higher financing costs.

Into this environment we face new tariffs on steel and aluminum, and we may eventually get tariffs on goods from Canada and Mexico. Ultimately, the data will have the last say about whether the reward was worth the risk. It might work out fantastically well, but I personally will remain skeptical until I see more evidence.

* Source : https://www.plasticsnews.com/news/assessing-us-motor-vehicle-market-amid-potential-tariffs

* Edit : HANDLER

- PreviousRecycling industry faces crisis as plant closures accelerate across Europe 25.03.20

- NextRapidMade launches thermoformable carbon fiber 25.02.20