North American machinery shipments continue to drop

main text

North American machinery shipments continue to drop

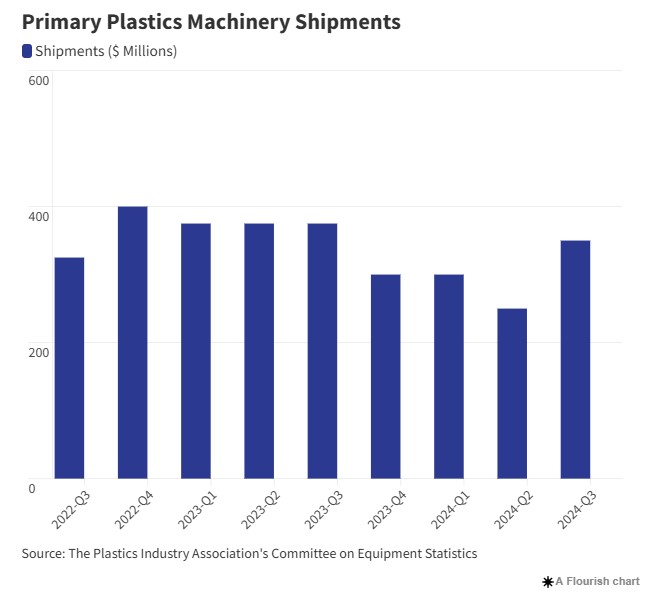

The value of shipments of plastics processing machinery tracked by the Plastics Industry Association were down 8.8 percent in the third quarter to $319 million compared to the same period in 2023.

The Washington-based trade group's Committee on Equipment Statistics (CES) released the data about North American shipments of injection molding and extrusion machinery based on feedback from reporting machine builders.

Compared with the second quarter, the total value of shipments is up 41.9 percent.

The NPE2024 trade show held in Orlando, Fla., in May was likely a factor in the quarter-to-quarter increase, according to Plastics News Economics Editor Bill Wood.

"I would expect that anything happening as a result of NPE would be third quarter," Wood said in a phone interview. "I think it's conspicuous that they don't mention it and there's underlying information they chose not to comment on — like the trend in new orders and the timing. In all likelihood, there was an NPE bump. Typically, there always was."

Shipments of twin-screw extruders, which have mixing and compounding capabilities, saw the most significant growth. These shipments were up 43.1 percent year-over-year and nearly tripled with a 149.7 percent increase between quarters.

Twin-screw extruders can process a wider range of materials that help processors incorporate recyclable content as well as convert post-consumer and post-industrial plastic waste into usable pellets and compounds.

PVC compounders, for example, have been investing in ways to improve the recyclability of rigid and flexible packaging in addition to being active in the infrastructure, housing and health care markets.

For single-screw extruders, which produce pipes, profiles and sheets, the shipment value dropped 27.8 percent from a year ago. Compared with the previous quarter, shipment values increased 31.9 percent.

The value of injection molding machine shipments trended the same way. The CES reported an 11.1 percent decline compared with the same period in 2023. Between quarters, however, shipment values rose 31.9 percent.

"The rebound in primary plastics equipment shipments in the third quarter confirms our Q2 statement that growth prospects remain, aligning with the positive outlook for the broader plastics industry — not just equipment. With baseline demand for plastic products holding steady, demand for plastics equipment is likely to grow over time," Perc Pineda, chief economist for the plastics trade group, said in a news release.

The second quarter wasn't a good one, overall. Machinery shipment values were down 36.2 percent to $224.8 million compared with the prior year. This factored into the increase between quarters in 2024.

The latest CES quarterly survey also showed 70 percent of respondents expect improved market conditions over the next year.

In addition, the percentage of respondents reporting an increase in quoting activity rose to 42 percent, vs. 40 percent in the previous quarter.

Interest rate drag

In the third quarter, U.S. plastics equipment exports were down 19.9 percent year-over-year.

However, exports rose by 2.1 percent to $348 million compared with the previous quarter.

The top markets remain Mexico and Canada for a combined $156.4 million, or 45 percent of the U.S. plastics machinery exports.

"U.S. manufacturing has faced an interest rate-driven slump," Pineda said. "The Fed's recent rate cuts — a 50-basis-point cut in September, followed by 25 basis points in November, and likely another 25 basis points in December — are expected to bring the Fed funds rate to a target range of 4.25 percent to 4.5 percent. This should gradually help the manufacturing sector move past the recent downturn."

The Trump bump

Some of the political uncertainty that hindered machinery investments also has been addressed with Donald Trump winning the presidential election.

Wood said his contacts in machinery and tooling have experienced a bump up in activity now that the election is over.

"That's the Trump bump," Wood said. "You saw it in the stock market rally right after the election. Trump will tell you that's because he won. But some believe, and I'm willing to look at it objectively, that people were holding back just worried that if he lost, we were going to have a huge debacle where he'd challenge and sue everybody, and nothing could get done."

Wood also pointed to Jan. 6, 2021.

"Four years ago, they tried to take over the capitol building," he said. "The Trump bump could just be that he won and there's going to be a peaceful transition of power. Maybe this caused some people to go ahead and release the funding for certain projects."

Any Trump bump would factor into fourth-quarter data, Wood added.

"We know from past experience that the fourth quarter is the best quarter for machinery. Everyone is spending their budget before the year ends to get tax breaks," Wood said.

* Source : https://www.plasticsnews.com/news/plastics-machinery-shipments-continue-drop

* Edit : HANDLER