PVC, PS prices rise in March as PP falls

main text

PVC, PS prices rise in March as PP falls

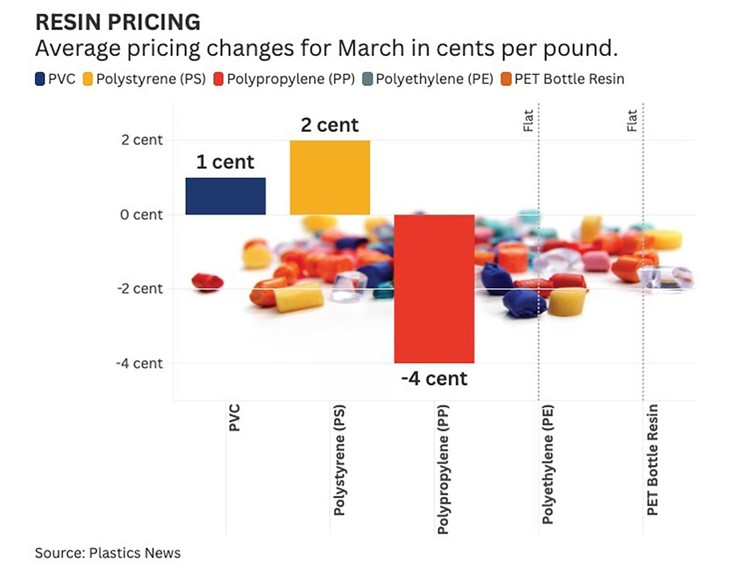

Early-year pricing activity sent North American prices for two commodity resins up and one down in March.

Prices for PVC and polystyrene increased, while polypropylene prices declined for the month. Prices for polyethylene and PET bottle resins were flat compared with February.

PVC prices ticked up an average of 1 cent per pound in March as buyers prepared for the upcoming construction season. Prices had moved up 2 cents in February after being flat for the previous two months.

A slow construction market, due in part to high interest rates, had a cooling effect on the PVC market for most of 2024. For the full year, PVC prices were down a net of 4 cents. But the market appears to be bouncing back as makers of pipe and other construction products build inventories in advance of warmer weather, which spurs construction activity.

A PVC supplier executive told Plastics News that PVC resin sales in the first two months of 2025 were up more than 3 percent compared with the same period in 2024. The executive added February operating rates were 6 percent higher than those seen in January.

Residential construction activity in the U.S. for February remained lukewarm, even as PVC demand rose. Construction accounts for about 60 percent of North American PVC demand. U.S. housing starts for February came in at an annual rate of 1.46 million, according to the U.S. Census Bureau. That number was down almost 1 percent from January and down more than 6 percent from the same month in 2024.

A recent report from consulting firm ICIS in Houston said the U.S. PVC market "is facing continued headwinds as tariff-related uncertainties persist."

According to the report, the domestic PVC market is expected to grow 1-3 percent this year but it continues to face challenges in housing and construction. Export markets for U.S. PVC "continue to wrestle with the threat of protectionist policies and tariffs at home and abroad," the report said.

Surprising PS increase

PS prices surprised some market watchers by increasing an average of 2 cents per pound in March. Prices had been flat in February after rising 3 cents in January. The March PS increase took hold even though prices for benzene feedstock were flat for the month. Benzene is used to make styrene monomer and influences PS prices.

One market watcher contacted by PN pointed out materials such as ethylene and rubber also affect PS prices. "In this case [for March], the higher price corresponds with some catch-up on raw material increases that were not fully covered by resin over the last few months," he said.

Surprising PP decrease

A 4-cent drop in March PP prices also surprised some market watchers. Prices had increased by that amount in February after rising 5 cents in January.

Price changes for PP again followed movements in polymer-grade propylene feedstock, but they were also influenced by larger macroeconomic factors.

"Supply [of PP] is ample, and demand is weak but showing signs of improvement," said Howard Rappaport, a market analyst with StoneX in New York. He added there's "plenty of [PP] market uncertainty over the implementation of tariffs."

According to Rappaport, PP has a more diverse end-use base — including automotive, appliance, medical and electronics — and is susceptible to wide-reaching regional tariffs.

Regional PE prices were flat for the second consecutive month in March after rising 5 cents in January. Ongoing efforts by PE makers to implement another 5-cent hike have been unsuccessful.

Exports of PE resin from the U.S. and Canada reached an all-time high of 46.6 percent of total production in 2024 — nearly 2 percent higher than the previous record. In the first three months of 2024, that number declined to 44.5 percent, as U.S. tariffs caused economic uncertainty.

There's concern among PE market watchers that tariffs proposed by the incoming Trump administration could lead to retaliatory actions by other countries — potentially affecting U.S. PE exports.

If U.S. PE exports drop in 2025, then it would be the first decline since 2021, when the market was still recovering from the COVID-19 pandemic. U.S. PE export volume more than tripled between 2015 and 2024, from 9.5 billion pounds to 29.5 billion pounds. Many producers added capacity during that period to take advantage of low-priced shale gas feedstock in the region.

In the PET market, North American bottle resin prices were flat for the second straight month in February after rising 4 cents in January. Prices had dropped a total of 11 cents in the last five months of 2024.

The January increase followed higher demand as beverage makers build inventory ahead of warmer weather and higher costs for paraxylene and purified terephthalic acid. PET prices were down a net of 10 cents in 2024.

In feedstocks, regional crude oil prices rose in March. West Texas Intermediate opened the month at $69.80 per barrel and increased more than 2 percent to $71.50 by the month's end. Market upheaval tied to a U.S.-initiated trade war then pushed prices down nearly 10 percent to $64.50 by late trading April 17.

Natural gas markets, relevant for PE and PVC production, began March at $3.83 per million British thermal units and climbed almost 8 percent to $4.12 by month's end. Prices have since tumbled nearly 21 percent to $3.26 by late trading April 17.

* Source : https://www.plasticsnews.com/materials/pvc-ps-prices-rise-march-pp-falls

* Edit : HANDLER

- PreviousACC sees ‘palpable optimism' in Trump deregulation agenda 25.04.19

- NextHerrmann Ultrasonics optimistic about growth in Mexico 25.03.20