Most commodity resins see hikes in March as PE stays flat

main text

Most commodity resins see hikes in March as PE stays flat

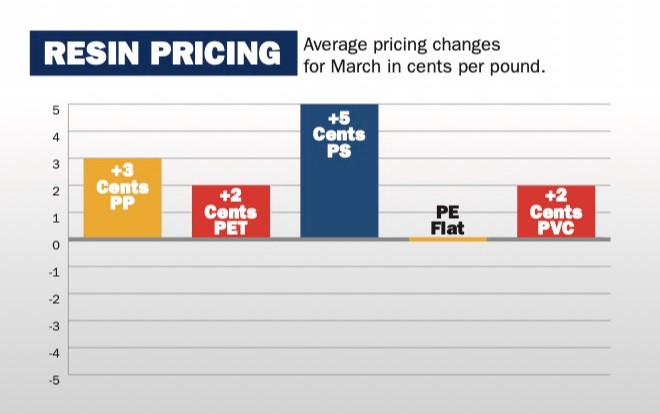

North American prices for most commodity resins continued to increase in March, resulting from a combination of seasonal demand and higher feedstock costs.

Meanwhile, polyethylene prices in March again made news by doing nothing. Prices were flat for the second consecutive month after climbing 5 cents in January.

Polypropylene remains the most volatile commodity resin. PP prices jumped up by an average of 3 cents per pound in March, marking the third straight monthly price hike and sixth in seven months for that material.

As with previous increases, the March move followed higher prices for polymer-grade propylene (PGP) monomer. Regional PP prices had jumped 4 cents per pound in February and 3 cents in January. The only month in the last seven that didn't see higher PP prices was December 2023, when prices were flat.

PGP supplies had been tighter earlier in 2024 because of mechanial issues at production sites and the impact of a brief cold snap in Texas, where much PGP and PP production is located.

Enterprise Products briefly shut down a PDH unit making PGP in Baytown, Texas. Ineos Olefins & Polyolefins also placed force majeure supply limits on PP resin made at its Chocolate Bayou plant in Alvin, Texas, because of mechanical issues.

These recent upswings in PP pricing are at odds with demand for the material, which has been in decline. PP supplier BlueClover LLC of New York said in a research report that, based on market dynamics, it expects PGP prices to be lower in April and May. If that takes place, then it most likely would lead PP resin prices to decline as well.

On March 27, BlueClover officials pointed out the physical PGP prices were down 10 cents per pound in the previous two weeks. They added that the total PGP price drop in April to May could be 13-16 cents.

"While we have seen some PGP price decreases intramonth in this seven-month PGP bull market, what's happening now appears to be a true correction in which the bull market for PGP will reverse for several months," BlueClover officials said.

"We believe that it's difficult for the PGP derivative market — of which PP makes up about 60-70 percent of PGP demand — to absorb PGP pricing north of 50 [cents per pound] for several months in a row.

"There was more room for PGP [prices] to fall vs. PP, so April may be a month where PP producers gain a little bit of margin back between PGP and PP. For example, if physical PGP pricing is down 10-12 cents, spot physical PP may only be down 5-7 cents, depending on the grade."

In a recent PP forecast, market analyst David Barry of PetroChem Wire in Houston said that North American PP makers are expected to keep operating rates low, in line with their demand forecasts, into 2024.

"Unlike the polyethylene industry, PP lacks a consistent export arbitrage to quickly move excess product when domestic sales fall short," Barry added.

New North American PP capacity opened in 2023 — mainly from Heartland Polymers' 1 billion-pound unit in Western Canda — and more is scheduled to come online in 2024, Barry said. That likely means PP makers must either find demand growth or reduce older, less efficient capacity, he added.

"Limping along with operating rates in the low 70 percent range is not a sustainable approach [for North American PP] for the long haul," Barry said.

Construction boosts PVC

Prices for PVC increased by an average of 2 cents in March. It was the second consecutive monthly price hike for that material. PVC prices had increased an average of 3 cents per pound in February after being flat in January.

The first quarter is typically a time when makers of construction products fill their PVC inventories in advance of construction season for most of the U.S. and Canada. Market sources told Plastics News that domestic PVC sales surpassed 900 million pounds in February, marking the first time they've reached that level since August 2022.

One market source said February production "showed no signs of turnaround activity impacting supply as inventory increased."

The source added that the March increase was partly an attempt by PVC makers to improve profit margins. Destocking activity in the market has ended, with "modest restocking" happening as buyers head into the second quarter.

Market analyst Paul Pavlov of Resin Technology Inc. said a relatively warm winter is bringing in construction work earlier in the year than expected. He added that the U.S. market is benefiting from "infrastructure spending that's been like none other before."

U.S. housing starts for February came in at an annual rate of 1.52 million, according to the U.S. Census Bureau. That number is up 2 percent vs. January and up almost 3 percent vs. the same month in 2023. Construction activity accounts for about 60 percent of North American PVC demand.

PS follows benzene

Polystyrene resin prices were up 5 cents in March after moving up 4 cents in February. Prior to those two increases, prices had dropped for three straight months, with those declines totaling 9 cents.

The 5-cent March hike followed a price increase for benzene, which is used to make styrene monomer. Benzene prices surged almost 13 percent to $4.10 per gallon in March, an increase of 46 cents.

One market watcher told PN that benzene prices have been affected by force majeure declarations, refilling inventory of that material in China after Lunar New Year and by shipping issues in Middle East trade lanes because of ongoing conflict in that region.

Warm weather pushes PET

PET bottle resin prices ticked up 2 cents in March after increasing 3 cents in February. Prices for the material had surprised market watchers by dropping 5 cents in January. The March increase was more connected to higher prices for feedstocks such as paraxylene and purified terephthalic acid (PTA), one source said.

Seasonal demand also played a factor in the PET price hike, as retailers prepare for higher beverage sales during warmer summer months. Bottled water — the largest beverage segment in the U.S. and a major consumer of PET — continues to grow but has slowed in recent years, according to a recent report from consulting firm Beverage Marketing Corp.

In the engineering resins market, prices for nylon 6 and 6/6, polycarbonate and ABS resins also increased in the first quarter of 2024. Nylon prices were up an average of 10 cents per pound, with prices for PC and ABS up 5 cents each.

First-quarter price hikes from nylon and PC reversed trends that had seen prices drop in the fourth quarter of 2023. Prices for all grades of nylon 6 and 6/6 had been down an average of 5 cents between October and December 2023, with PC prices down an average of 2 cents. But stronger demand and higher feedstock costs sent prices for those materials — as well as for ABS — in the other direction in the first quarter.

Nylon resin supplier BASF placed force majeure supply limits on some nylon grades in late February. In a letter to customers, officials cited "unprecedented complications impacting operations in our [nylon] production" as reasons for BASF taking that action. The firm "is not able to supply required volumes of materials necessary to meet market demand," they said.

Celanese Corp. and AdvanSix Inc. both cited higher raw material costs in letters announcing price increases for nylon in mid-February and early March. BASF also had announced a price increase for nylon feedstock caprolactam in early March.

Then there's PE

Polyethylene prices now have been flat for five of the last six months. PE demand in March wasn't very strong, sources said, but suppliers were able to keep the market balanced by reducing the amount of material sold into export markets.

Unlike flat February pricing, which surprised some market watchers, flat pricing in March was the reflection of a fairly stagnant market, sources said.

In feedstocks, West Texas Intermediate oil prices opened March at $78.30 per barrel but climbed more than 6 percent to $83.20 by the end of the month. From that point, prices have bounced up another 2.5 percent to close at $85.30 on April 16.

Markets for natural gas — used as a feedstock to make PE and PVC — have seen large declines in recent months. Prices for the material started March at $1.86 per million British thermal units but slipped more than 5 percent to $1.76 by the end of the month. From that point, prices have continued to slide, closing at $1.69 on April 15 — down more than 3 percent for the month to that point.

* Source : https://www.plasticsnews.com/resin-pricing/most-commodity-resins-see-hikes-march-pe-stays-flat

* Edit : HANDLER

- PreviousMachinery shipment values drop 24% in first quarter 24.05.21

- NextWaiting for normal in a volatile post-COVID economic reality 24.04.21