Auto suppliers anticipate rough conditions in next six months

main text

Auto suppliers anticipate rough conditions in next six months

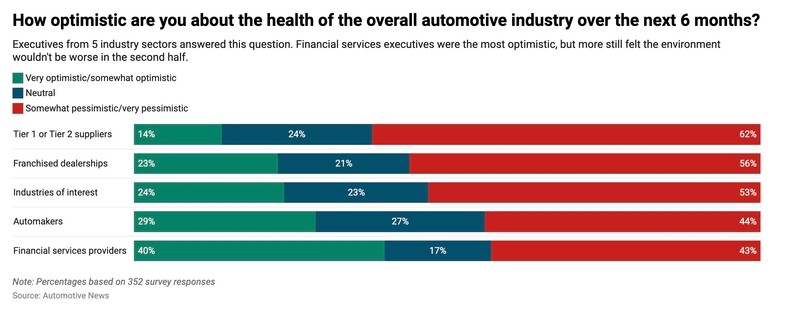

Auto suppliers, grappling with tariffs and electrification uncertainty, are more pessimistic about their companies' overall performance than automakers and dealers.

Supplier professionals also have lower expectations about how their companies will perform and how the auto sector will fare over the next six months, according to Automotive News' inaugural Auto Industry Confidence Index.

Parts makers are coming off of years of lower profit margins driven by the pandemic, inflation and supply shortages that the industry navigated in the first half of the 2020s. Now, tariffs and changing product plans are making it difficult for suppliers to place bets on where to build their products and which parts they should make.

"This has given me more existential concern than anything before," said a Tier 1 supplier executive, who asked to not be named given the sensitive political nature of the topic. "The North American industry is frozen."

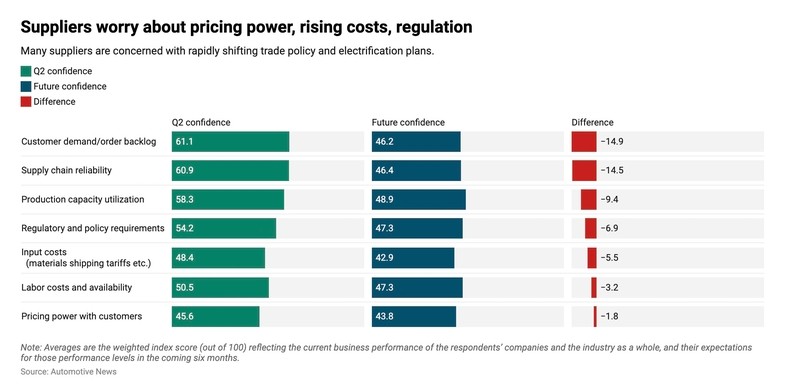

Automotive News, a sister publication of Plastics News, conducted the first in a series of quarterly surveys to measure the sentiment of the professionals across the auto industry. Each sector receives a weighted index score that reflects the current business performance of the respondents' companies and the industry as a whole, as well as their expectations for performance over the next six months.

A lower score on the 100-point scale indicates pessimism. A higher score shows optimism.

Tier 1 and Tier 2 suppliers were given an index score of 51.3, below the industry average of 55.5 and the lowest of any other sector, including franchised dealership executives (55.5) and automakers (57.6).

Suppliers were given a 60.8 rating for how they feel about their current performance, below the industry average of 64.2. Their sentiment for the next six months is also more negative, with a 41.9 rating, below the industry average of 46.9.

The scores reflect a state of paralysis for many companies because of rapidly shifting trade policy and electrification plans. Automakers have focused on short-term decisions at the expense of medium- and long-term planning, putting major investments on hold and making it difficult for parts makers to earn new business, one supplier executive said.

About 47 percent of suppliers said they would rate their company's current performance as excellent or good, compared with 56 percent of dealers and 61 percent of automakers.

Meanwhile, about a third of suppliers expect their organization's overall performance to worsen over the next six months, compared with about a quarter who expect it to improve. The supply base was the only sector in which more respondents said they expected the next six months to be worse than those that said it would be better.

Suppliers largely anticipate most aspects of their businesses and the industry to decline over the next six months, the survey showed. They expect customer demand, supply chain reliability, production capacity utilization, regulatory and policy requirements, labor costs and availability, input costs and pricing power with customers to deteriorate over the remainder of the year, the survey found.

"Our customers don't know what they're going to build, and they don't know where they're going to build them," the supplier executive said.

As a result, many suppliers are in "wait-and-see mode," said Dan Lee, principal at Plante Moran.

Suppliers "have stalled their growth initiatives because of economic uncertainty due to tariffs," Lee said in the survey.

The Auto Industry Confidence Index surveyed 609 automotive professionals, including 140 employees at parts makers and materials companies, from June 12 through June 22. About half of supplier respondents were based in the U.S., while a third were in Europe.

* Edit : HANDLER

- PreviousPlastics machinery orders nudge up 25.08.20

- NextPlastics treaty talks collapse; next steps unclear 25.08.20