Tariffs bring short-term gains, long-term questions for plastics indus…

main text

Tariffs bring short-term gains, long-term questions for plastics industry

Leo Michael

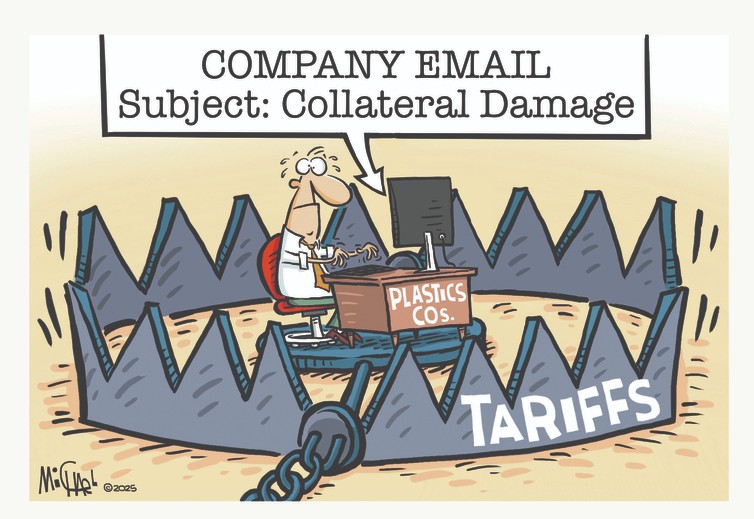

Trade policy rarely produces all winners or all losers. And with the latest round of tariffs targeting imported plastics machinery, molds and recycled resins, it's clear the U.S. plastics industry is facing both opportunity and disruption.

Yes, there are some potential bright spots. U.S. mold makers — particularly small and midsized shops — could see a bump in business as tariffs make overseas tools more expensive.

U.S. recyclers may also benefit from new reciprocal tariffs on imported PET, which could push buyers to turn back to domestic supply.

But those silver linings come with a cost. For processors across North America, the expanding list of Section 232 and reciprocal tariffs creates deep uncertainty, especially for companies that rely on imported machines, molds or components to meet customer demand and hit sustainability targets.

The new 50 percent tariffs on steel and aluminum content hit a broad swath of equipment, including injection molding machines, plastic and rubber molds, material handling systems and industrial robots. Many of these products are made in Germany, Japan and Canada — long-time trade partners and key suppliers to the U.S. plastics industry.

The impact is already being felt. German machinery group VDMA warned the tariffs are sending their members "hurtling toward the precipice of an existential crisis." In Canada, the mold-making community is sounding the alarm that decades of cross-border manufacturing integration are at risk.

The Japan Plastics Machinery Association sent a letter to the Plastics Industry Association this week asking for its assistance in dealing with the tariffs.

And here in the U.S., processors and toolmakers are stuck in the middle.

Capital spending is slowing. Orders are delayed. Companies are waiting to see what rules will stick — and which could be reversed in court. That wait-and-see attitude comes at a cost.

A recent study from consulting firm Wipfli found that 53 percent of manufacturers surveyed were operating below capacity in the second quarter. Tooling programs are being postponed or shelved entirely. Even companies with reshoring potential are hesitant to act without clarity on tariff exposure. And while quoting activity is up, few firms are committing to large equipment purchases while prices remain uncertain.

Let's not forget: More than 70 percent of plastics processing equipment in the U.S. is imported. That includes the sophisticated injection molding machines and robotics that power everything from medical device production to lightweight automotive parts. Tariffs on those machines don't just affect bottom lines — they can limit innovation, reduce efficiency and delay the shift to more sustainable operations.

Meanwhile, U.S. recyclers are navigating shifting ground. The new reciprocal tariffs that took effect this month could add 10 to 14 cents per pound to the price of imported recycled PET pellets. Imports had surged in recent years, with resin from Asia and Latin America gaining share.

The new tariffs could give domestic recyclers a chance to regain market — but also add cost pressures and pricing instability at a time when brands are reevaluating recycled-content commitments amid softening demand.

It's a classic trade-off: protectionism to help one part of the industry risks undercutting another. In some cases, the same company may feel both sides of the equation.

We've said it before: The plastics industry needs clear, consistent policy to plan ahead. That includes trade policy. Manufacturers can't make multimillion-dollar tooling investments or hire new workers if the regulatory ground shifts every 90 days.

It's refreshing to see an industrial policy from Washington that encourages manufacturing — although this one appears tilted too far in favor of steel and aluminum producers at the expense of other vital sectors, including plastics.

In the long run, we need real solutions — ones that support innovation, encourage recycling and ensure that plastics processors have the tools they need to compete globally.

* Edit : HANDLER

- PreviousEuropean resin prices in a post-summer slump 25.09.21

- NextPlastics machinery orders nudge up 25.08.20