Plastics machinery orders slow amid trade uncertainty

main text

Plastics machinery orders slow amid trade uncertainty

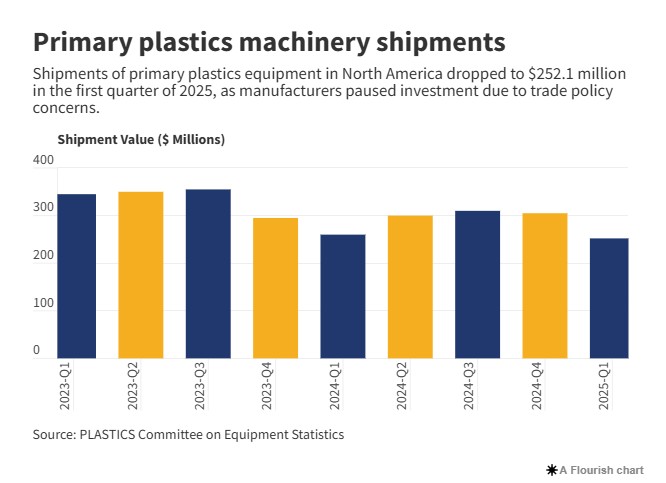

North American plastics processors put a pause on overall machinery investments in early 2025, particularly for injection molding presses, as tariff and trade uncertainties mounted.

The total value of plastics machinery shipments for the first quarter was estimated at $252.1 million, which is down 4.6 percent compared with last year and 17.5 percent lower vs. the fourth quarter of 2024.

The figures were released June 12 by the Plastics Industry Association's Committee on Equipment Statistics (CES).

While shipments of extruders were strong and increased by double digits year-over-year, injection molding machine shipments were a drag.

The data says shipments of single-screw extruders were up 31.2 percent and twin-screw extruders were up 10.9 percent compared to a year ago, but injection molding shipments fell 8.9 percent.

Compared with the prior quarter, single- and twin-screw extruder shipments increased 17.2 percent and 3.2 percent, respectively, while press shipments dropped 21.8 percent.

"Shipments appeared to pause in the first quarter as businesses reassessed strategies amid uncertainty surrounding U.S. tariffs and trade policy," Perc Pineda, chief economist for the Washington-based association, said in a news release.

"While there appear to be green shoots in plastic product manufacturing, capacity utilization and the broader manufacturing sector in the first quarter, it is too soon to project the short-term path of equipment shipments as trade policy remains in flux," Pineda said.

The equipment statistics committee also reported on international trade. U.S. plastics equipment imports rose 6.2 percent in the first quarter to $939.4 million, which is up 5.5 percent from the prior year.

Exports fell by 1.1 percent from the prior quarter to $325.3 million, marking an 18.6 percent year-over-year decline.

"The bulk of plastics machinery is imported and that might have got a quick juice in the first quarter with demand pulled forward by the anticipation of higher prices," Plastics News Economics Editor Bill Wood said in a phone interview.

"I'm concerned about how much demand was pulled forward and whether the second quarter will be worse," Wood said.

CES members also were surveyed about market conditions. The first-quarter survey indicates 62 percent of respondents expected market conditions to remain steady or improve over the next 12 months. That's down from 83 percent in the previous quarter.

"That's not good," Wood said. "People in this business are naturally optimistic."

However, 42 percent of surveyed CES members reported an increase in quoting activity, which is an increase from 31 percent in the prior survey.

"One cannot overlook the capacity of plastics processors to meet end-market demand previously filled by imports affected by tariffs," Pineda said. "In the first quarter, business investment in industrial equipment rose 4.8 percent (SAAR), with metalworking machinery up 15.8 percent. Increased domestic plastics conversion would have positive ripple effects throughout the industry's supply chain."

Wood said quoting activity isn't hard data.

"That's a very soft indicator. While it's not something to ignore, you can't pay the bills with quoting," Wood said.

* Source : https://www.plasticsnews.com/news/plastics-machinery-orders-drop-tariff-concerns-cloud-2025-outlook

* Edit : HANDLER

- PreviousWoojin Plaimm Newsletter, July 2025, Vol.27 25.07.18

- NextTariff turmoil as trade tensions intensify 25.06.19