Primary machinery shipments fall; ‘slack' in plastics production cited

main text

Primary machinery shipments fall; ‘slack' in plastics production cited

Plastics Industry Association

North American plastics processors slowed their machinery investments for injection molding and extrusion late in 2024 because of a "slack in plastics production."

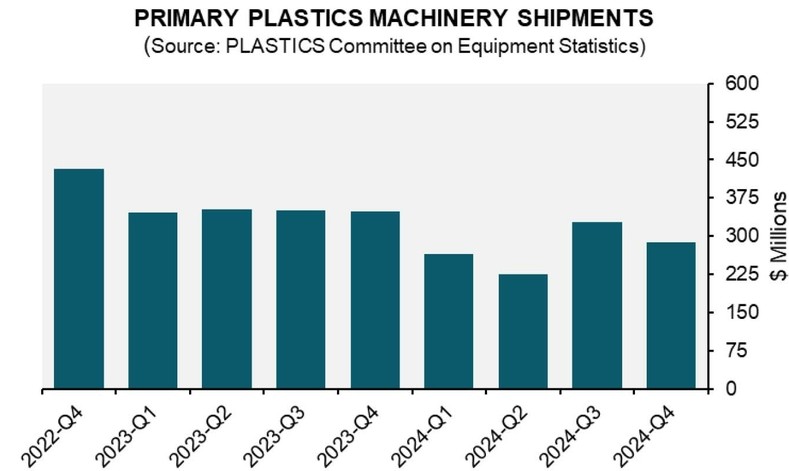

The shipment value of primary machinery dropped to an estimated $288.8 million in the fourth quarter of 2024, according to the Plastics Industry Association's Committee on Equipment Statistics (CES). That's a 17 percent drop compared to the prior year and a 12 percent decrease from revised third quarter estimates.

Shipments of single-screw extruders, which manufacture products like pipes and siding, fell 32.6 percent compared with the prior year and 24.8 percent vs the third quarter, when machine builders expected to see a bump from NPE2024.

Shipments of twin-screw extruders, which are used for mixing, compounding and to manufacture products like some windows, dropped 8.3 percent year over year and 48.4 percent from quarter-to-quarter.

Injection molding shipments saw declines of 16.1 percent compared with the fourth quarter of 2023 and 5.5 percent vs. the third quarter.

"Plastics equipment shipments pared back their gains in the third quarter, underperforming forecasts," the association's Chief Economist Perc Pineda said in a March 14 news release. "Weakness in U.S. manufacturing persisted in the fourth quarter, driven by increased economic policy uncertainty amid expectations of a shift in U.S. trade policy after the November elections.

"Plastics demand in the U.S. remains stable. However, slack in plastics production is leading to weaker-than-expected demand for primary plastics equipment. Additional cuts in the [Federal] funds rate are still projected this year. Lower interest rates and greater clarity on U.S. economic policy, particularly on trade, would help reduce uncertainties across the plastics industry supply chain," he added.

Plastics News Economics Editor Bill Wood sees it differently.

Primary machinery shipment values aren't just underperforming the forecast and plastics demand isn't stable, Wood said in a phone interview.

"Nothing is stable. It's tumultuous, it's turbulent, it's erratic, it's tempestuous. Stable is the abject opposite of what the environment is right now, and machinery data are screaming that," Wood said. "I won't say it's never happened, but for the fourth quarter to be weak compared to other quarters, you sit up and take notice."

The plastics industry is big and there may be pockets where some companies are doing better than others, Wood said.

'But I don't think most people are looking at their numbers and saying, 'Oh boy, this is better than I expected,'" Wood said. "Everything is worse than expected."

CES members also were surveyed about market conditions. The plastics association says 83 percent of respondents expect conditions to remain steady or improve over the next 12 months.

In addition, 43 percent reported that quoting activity was holding steady, while 31 percent reported an increase in quoting activity compared with the previous quarter.

Wood said the responses seem appropriate for anyone filling out the survey in the fourth quarter.

As the first quarter of 2025 comes to an end, Wood said: 'I think it will continue to get bad before it gets better but some of the factors could be reversed very fast — like avoiding a government shutdown, firing and rehiring federal employees and tariffs. They could end tomorrow and wars in the Middle East and Ukraine may go away."

As for international trade, 2024 closed with U.S. plastics equipment total exports falling 5.5 percent to $329 million in the fourth quarter.

Mexico and Canada remained the largest export markets for plastics machinery, with total exports to these countries reaching $157.9 billion, accounting for 48 percent of U.S. total plastics machinery exports.

* Source : https://www.plasticsnews.com/news/primary-machinery-shipments-fall-slack-plastics-production-cited

* Edit : HANDLER