Is it time for plastics circular economy to ‘shift gear’?

main text

Is it time for plastics circular economy to ‘shift gear’?

There is evidence that relying on voluntary commitment of companies to control plastic pollution has been less than effective. More effort is needed to achieve successful recycling of plastic waste, writes Wang Ren.

According to the 2022 progress report by the New Plastics Economy Global Commitment, which represents 20% of the plastic packaging used globally, the total amount of virgin plastic used by its signatories in 2021 has returned to the baseline level of 2018, reversing the 2019 and 2020 downward trend.

The proportion of packaging in reusable mode among its signatories has been decreasing year by year, and it was only 1.2% in 2021. Obviously, relying solely on the voluntary commitments of companies will not be able to make significant progress in key indicators, or will even regress.

Leading environmental protection organizations and institutions around the world are aware of this tough challenge. Therefore, in the past two years, they have been actively putting efforts on promoting the Global Plastics Treaty.

Global Plastics Treaty: High hopes but full of hurdles

At the fifth United Nations Environment Assembly, UN member states agreed to a legally binding international agreement to combat plastic pollution. This has become one of the world's most ambitious environmental actions since the 1989 Montreal Protocol. But huge differences exist in the positioning of the Global Plastics Treaty between different countries.

As the world's major plastic production and consumption country, the United States, with a plastic recycling rate of only about 6%, proposed a negotiation position on a country basis that allows individual countries to determine the total amount of plastic to produce and use. The US proposal also puts emphasis on recycling and investing in infrastructure, which is hardly convincing.

Many people around the world have lost faith in similar commitments such as the Paris Agreement, as they believe that such actions can no longer stop the pace of global climate change. In addition, during the negotiation of the Global Plastics Treaty at the Plastic Recycling Conference held in early March this year, the spokesperson for the US delegation said that he hoped that the agreement would be an overall plan that includes reduction and reuse.

The UN received 60 public proposals from Member States and some 200 proposals from NGOs. The second round of consultations will be held in Paris from May 29 to June 2. It is expected that several major proposers will clash head-on. Among them, the European Union and the High Ambition Coalition to End Plastic Pollution, co-chaired by Norway and Rwanda, proposed to set a global goal to cut plastics production. The coalition stated that "each party should be required to take effective measures to reduce the production of primary plastics polymers to an agreed level to reach a common target".

Obviously, this proposition differs greatly with the proposals from other countries, such as the United States and Saudi Arabia.

EU as the locomotive for developing a global plastics circular economy

As the international communities pay more attention to plastic pollution control, the chasm between each other becomes more apparent. Since the EU’s Green New Deal regards the circular economy system as pivotal, the setting up of EU’s circular economy provides a powerful model for the world. Its advancement and effectiveness will provide a valuable reference for other countries and regions.

After launching the EU Plastic Strategy and Single Use Plastics Directive, the EU is promoting the establishment of a comprehensive European plastic circular economy through the Packaging and Packaging Waste Regulation (PPWR). Obviously, the setting up and management of recyclability, as well as the requirements for recycled content, etc. will not only have a huge impact on the EU internal market and the packaging industry, but will also cause a ripple effect on the interests and operations of external stakeholders.

Among them, regulations such as the EU Circular Economy Action Plan stipulate that by 2030, all packaging must be recyclable or reusable under economically feasible conditions. Therefore, based on the definition of recyclability, related certification and packaging labels will have a certain impact on packaging products that are exported to the EU from countries including China.

In addition, the determination of recycled content will not only affect the physical recycling industry inside and outside of the EU, but also impact some so-called advanced recycling technologies, such as BHET depolymerization. Currently, the ReMade labelling mechanism under discussion in Australia not only encourages the use of recycled content, but also proposes issues such as whether the main changes of ReMade products must take place in Australia, and 50% of the recycled content must be produced locally.

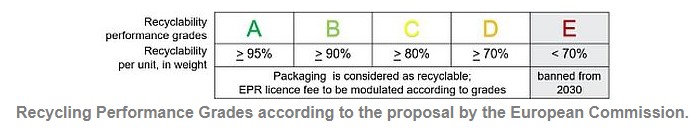

The Recycling Performance Grades proposed by the European Commission is based on the proportion by the weight of recyclable materials in the packaging. Packaging that contains less than 70% non-recyclable materials will be banned from 2030. From 2035, only packaging that can be recycled on a large scale will be allowed to enter the market. It means that packaging can be collected, sorted and recycled through advanced infrastructure and processes that are able to cover 75% of the EU population. However, the recycling performance of innovative new-to-market packaging will not be graded within five years after its launch.

At present, some European companies require China to provide recyclability certification on the packaging of products for export to the EU. This requirement generally covers two certifications: the German Institute Cyclos-HTP certification and the RecyClass certification of PRE (Plastic Recyclers Europe).

Last year, China’s packaging exports totaled more than US$55 billion, of which about 66% was plastic packaging. It is believed that a certain portion of it was exported to the European market. Therefore, Chinese packaging companies exporting to the EU still have seven years to improve the recyclability of their products. And during these seven years, how these companies are going to follow up and how China’s domestic policies and regulations can guide the market will interrelate with each other and have an important impact on the development of the country’s packaging industry.

A clear system urgently needed for the plastic recycling industry

In 2021, China unveiled the 14th Five-Year Plan on the circular economy and the 14th Five-Year Plan for plastic pollution control. Coupled with the No. 80 Document of the Policy Recommendation on Plastic Pollution Control issued in the previous year, these policies have set the basis for development.

At present, industries such as packaging, electronic appliances, automobiles, construction and agricultural plastics have developed different circular economies. In plastic packaging, which is the market segment that generates the most plastic waste, post-consumer plastic packaging waste is basically collected and stored through an informal system. In the past two years, in order to save labor costs and improve quality, automatic sorting has been quickly adopted in the recycling of PET bottles.

Meanwhile, the scale of bottle flake companies is expanding and the production capacity of granulation is also growing rapidly. In addition, for the recycling of HDPE and PP miscellaneous plastics and hollow plastics, thanks to the active involvement of private companies and the large demand at the back end, production capacity is gradually focused and new production capacity is building up very quickly with some high-end materials being exported. However, as overseas companies increasingly prefer local procurement, the sustainability of export demand is uncertain.

Although market forces have promoted some developments in some sectors of the packaging industry, it is difficult to transform the whole system due to limited back-end demand, capital investment and R&D. In film and soft packaging recycling, due to the lack of external incentives, the industry has not improved significantly in recent years and is still operating at a low level.

Gradual increase in recycled content of appliances and automobiles

More than half of the used electronic appliances is collected through informal channels, similar to that of post-consumer packaging waste, making it difficult to collect data. Over the past two years, the National Development and Reform Commission and other governmental departments have been passing laws to make electrical appliance manufacturers take up the responsibility of recycling their used products. Among them, in 2016, the government proposed in the EPR system policy that by 2025, the proportion of recycled raw materials used in key products should reach 20%.

In fact, most of the recycled raw materials produced from used home appliances are downgraded for use. In the past two years, due to the widespread advocacy of the circular economy, together with the EPEAT rating requirements for the procurement of electronic products in the US market and commitments made by manufacturers, electronics and electrical products have begun to widely use recycled materials, leading to a gradual increase in the proportion of recycled materials. In the past two years, more upstream manufacturers and suppliers have joined the production and modification of recycled plastics, further improving its quality.

According to automobile recycling policies, the recycled content of key components is proposed to be 5%, which to a certain extent has promoted the adoption of recycled plastics in related industries. As industrial policies become more clearly defined and encouraged, the use of recycled plastics is expected to increase in car floor mats, baffles, dials, decorative parts, roofs, battery casings and handles. At the same time, it will also allow recycled plastics from other industries to flow into automotive products, such as the PP disassembled from electrical appliances.

However, applying recycled plastics in the automotive industry requires going through complicated approval procedures. It is a lengthy process for recycling companies to produce recycled materials, modify them, test the parts for vehicle applications and pass the approval procedures. Supplying these products to foreign brands may require other procedures to obtain approval from their overseas headquarters. In addition, the value chain is quite long: dismantling, modifying, processing, assembling and putting them into the vehicle. The pressure from each production stage leaves the recycled material supplier with only a meagre profit, hindering the attractiveness and investment of recycled materials in vehicle applications.

At present, recycled materials used in automobiles are relatively mature materials, such as recycled PET and recycled PP. Since the automobile market in general is sizable with many new energy vehicle companies headquartered in China, companies engaged in recycled materials and material modification hope to enter this lucrative market and share a slice of the profit.

China's construction industry uses a large number of recycled plastic products, such as sunshade nets and pipes, but the standardization and management need to be stepped up urgently in the collection of sunshade nets and the use of recycled materials for pipes. As for agricultural plastics, pesticide packaging waste and plastic film recycling have been longstanding difficult problems with many pilot projects but questionable continuity. While plastic pollution control cannot be completely solved by recycling alone, recycling is definitely a key solution.

Yet whether it is circular economy or recycling, it cannot be realised solely by managing the back-end. Current policies, publicity and actions are all focused on managing the back-end without formulating systematic plans. Even in recycled PET bottles, which is doing better than other recycled plastics, huge problems still exist on the front-end, such as the use of PVC labels and adhesives that are not easy to recycle. Without a clear positioning, uncertainty remains and companies need to face unnecessary risks in the future. After all, no company would like to stay in “neutral gear” on their road of development.

Source : https://www.adsalecprj.com/web/news/article_details?id=60884&lang=1

Edit : HANDLER

- PreviousA positive outlook for bioplastics 23.04.20

- NextCPRJ Survey: 78% of respondents show optimism about 2023 23.03.19