With 2023 still unsettled, experts assess resin markets for 2024

main text

With 2023 still unsettled, experts assess resin markets for 2024

North American resin prices barreled through November with the same reckless behavior they've shown in the first 10 months of 2023 — and 2024 might hold more of the same.

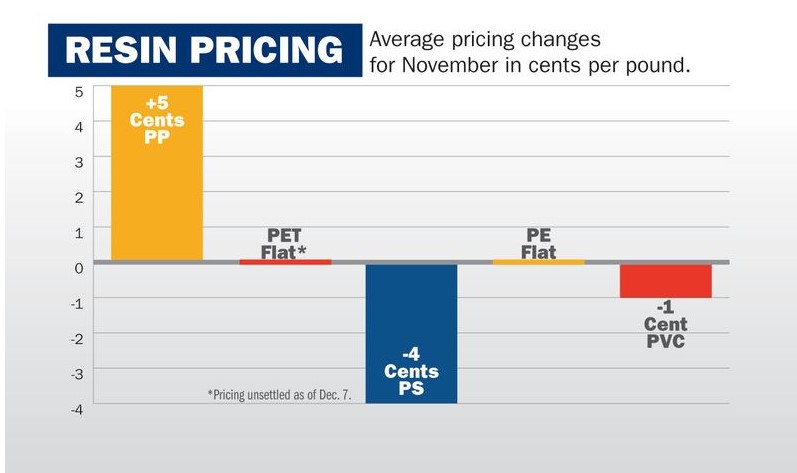

Prices for PVC and polystyrene declined for the month, with polypropylene prices up, polyethylene prices flat and prices for PET bottle resin unsettled as of Dec. 7.

PP prices surged for the third consecutive month, following higher prices for polymer-grade propylene (PGP) feedstock. Prices for PP closed up an average of 5 cents per pound for November.

PP prices now have increased for three consecutive months, after climbing 4 cents in October and 4.5 cents in September. Combined with previous increases and decreases, North American PP prices now are up a net of 17 cents per pound in 2023.

Supplies of PGP tightened in September and have stayed that way because of production outages at some propane dehydrogenation (PDH) units.

Recent upswings in PP pricing are at odds with demand for the material, which has been in decline. Market sources cited American Chemistry Council data that showed North American PP demand was down about 4 percent on a monthly basis in both September and October.

Lackluster PP demand also is at odds with the addition of more than 2 billion pounds of new capacity in North America in the last 18 months. ExxonMobil Chemical in January opened a new PP unit in Baton Rouge, La., with annual production capacity of almost 1 billion pounds. ExxonMobil officials said the new unit helps the firm meet growing demand for durable, high-performance plastics.

In Strathcona County, Alberta, new market entrant Heartland Polymers opened a PP resin unit with 1.2 billion pounds of annual production capacity in mid-2022. In March, Heartland added production of PDH at the site.

In an interview with Plastics News, Yonas Kebede, PP sales and marketing director, said Heartland's new PP plant "already has run at max rates. … It's proven out." He added that major end markets for the firm's PP output are fiber, film, biaxially oriented film and injection molding.

The regional PP market lost some capacity in September when Braskem America stopped production on a 450 million-pound-capacity line in Marcus Hook, Pa. Braskem operates a second line at the site with the same amount of annual capacity that will remain in operation.

Declines for PVC and PS

North American prices for PVC and polystyrene resins declined in November, as demand for both materials decreased late in the year. PVC prices declined by an average of 1 cent per pound after being flat for the previous two months.

Combining increases and decreases, prices for PVC now are down a net of 1 cent in 2023. One market watcher told PN that the PVC market "is going into the usual slowdown."

U.S. housing starts for October came in at a 1.49 million annual rate, according to the Census Bureau. That number is up more than 1 percent vs. September, but down more than 4 percent vs. the same month in 2022.

In the first nine months of 2023, sales at Westlake's Corp.'s Performance Materials unit — including PVC and PE resins — were down almost 40 percent to just under $3.6 billion.

In the PS market, prices fell an average of 4 cents per pound in November, following price drops for benzene, which is used to make styrene monomer. PS prices had been up 6 cents in October after climbing 3 cents in both August and September for a three-month price hike of 12 cents.

In the third quarter of 2023, adjusted EBITDA at the Americas Styrenics joint venture of Trinseo was down 17 percent to $19 million. Trinseo's PS resin sales outside of the Americas were down 52 percent to $577 million in the first nine months of 2023.

Why PE prices are flat

PE resin prices were flat for the second straight month in November after moving up 3 cents in both August and September. PE prices now are up a net of 9 cents so far in 2023.

Since domestic PE demand growth hasn't been very high, export sales have carried the PE market in 2023. Exports now account for more than 40 percent of North American PE sales.

"Supplier production rates and support of record exports is essential to keep balanced inventories and impact current resin price negotiations for the 2024 supply contracts," market analyst Mike Burns said in a recent market update. "It's not likely production rates will decline this year or into Q1 2024."

He added that key PE market indicators into the first half of next year will continue to be oil demand/price, strength of the Chinese economy in China and the ability to overcome any potential shipping concerns in the Panama Canal.

"Without domestic production disruptions, the means to export will be the foremost price influence next year," Burns said.

Consulting firm C-MACC of Houston, in its own update, said U.S. contract reference PE prices are elevated relative to spot prices and are "notably higher" than pre-COVID premiums.

"The North American PE production cost advantage is significant compared to Europe and Asia, suggesting a 'less bad' profit setting amid global oversupply at the expense of many abroad," C-MACC said.

North American PE makers also have added production capacity in the last two years. In October, Bayport Polymers LLC launched production on a new PE resin unit with 1.4 billion pounds of annual production capacity in Pasadena, Texas. Officials with the firm, which operates as Baystar, said the new unit is the first of its kind in North America, with proprietary Borstar-brand technology from Borealis, one of the partners in the joint venture.

The new line more than doubles Baystar's production capacity in Pasadena. In an interview with PN, Baystar President Diane Chamberlain said Baystar is taking "a different approach" to the PE market. "We want to solve problems," she added. "We're small enough to be nimble and make unique products."

Examples of products that can be made with Baystar material and recycled content include heavy duty shipping sacks and form, fill and seal packaging applications. And although many North American PE makers are becoming increasingly dependent on export markets, Baystar officials said the firm "doesn't intend to export a lot of product."

Baystar became a fully integrated PE resin maker in 2022 with the startup of a 2.2 billion-pound-per-year ethane cracker unit in Port Arthur, Texas, which supplies ethylene feedstock to Baystar's three PE production units. Bayport Polymers was formed in 2018 by French energy and materials firm TotalEnergies and Novealis Holdings LLC, a joint venture between materials firms Nova Chemicals of Calgary and Borealis AG of Vienna.

In early 2022, Gulf Coast Growth Ventures started production at two new PE resin units in Corpus Christi, Texas. GCGV is a 50-50 joint venture between ExxonMobil and Saudi Basic Industries Corp. of Riyadh, Saudi Arabia. The facility is making materials used in packaging, agricultural film, construction materials, clothing and automotive coolants. It includes two PE units with combined annual production capacity of almost 3 billion pounds.

ExxonMobil officials said the GCGV plant "positions us well to help meet growing global demand for performance products while providing meaningful investment in the U.S. Gulf Coast."

In Monaca, Pa., Shell Chemical continues to ramp up production at a massive PE resin unit that it opened in late 2022. That unit faced some challenges in 2023, losing about two months of production and being fined almost $10 million by the state of Pennsylvania for excessive emissions.

The Monaca site has annual production capacity of about 3.5 billion pounds and is the first major PE manufacturing complex in the Northeast U.S. and the first U.S. plant built outside of the Gulf Coast in at least 40 years. Officials have said most of the site's output is intended to be sold into the domestic market.

Looking ahead, another major new PE resin unit is set to open in 2026. In late 2022, Chevron Phillips Chemical Co. and QatarEnergy announced the formation of Golden Triangle Polymers Co. LLC, a joint venture that will spend $8.5 billion to build a petrochemicals complex in Orange, Texas.

The complex will have two high density PE lines, each with annual capacity of 2.2 billion pounds, and an ethane cracker with annual capacity more than 4.5 billion pounds. The project will create 500 full-time jobs and about 4,500 jobs during construction.

CP Chem will have a 51 percent stake in the JV. CP Chem and state-owned QatarEnergy have collaborated for more than 20 years on assets they operate together in Qatar. QatarEnergy, formerly Qatar Petroleum, ranks as the world's fifth-largest natural gas supplier.

* Source : https://www.plasticsnews.com/resin-pricing/2024-resin-market-outlook-2023-still-unsettled-plastics

* Edit : HANDLER

- PreviousResin price hikes may follow Gulf Coast freezing temperatures 24.01.21

- NextNovember European recycled resin prices vary, demand subdued 23.12.20