How much lag time before the economy recovers?

main text

How much lag time before the economy recovers?

For the next few weeks — and possibly longer — I am going to focus on the expected lag time between the predominant trends in interest rates and the overall economy and the subsequent trends in the major indicators for the plastics industry and the manufacturing sector.

Let me explain what I mean by this.

I have argued many times in recent months the higher interest rates have impeded demand for manufactured goods, including many plastics products. After all, that was the Fed's intention when it decided to raise the Fed Funds Rate: to destroy demand and thereby restrain upward pressure on prices. By most accounts, this effort has been a success. Demand for many manufactured goods has diminished, and the rate of inflation has decelerated.

Recently, the Fed decided to take its foot off the brakes, metaphorically speaking. Its objective now is neither to restrain nor to spur demand, but rather to return the Fed Funds Rate to a neutral level and let market forces establish the equilibrium between supply and demand.

The issue in all of this for manufacturers and those of us who report on the plastics industry is the amount of time it takes for demand for manufactured products to start to increase now that the Fed has started the process of lowering its interest rate. Nobody expected demand to pick up immediately, but more than a few sectors of the economy are still under stress, so sooner is better than later. That is why the lag time concerns me, and the clock is now ticking.

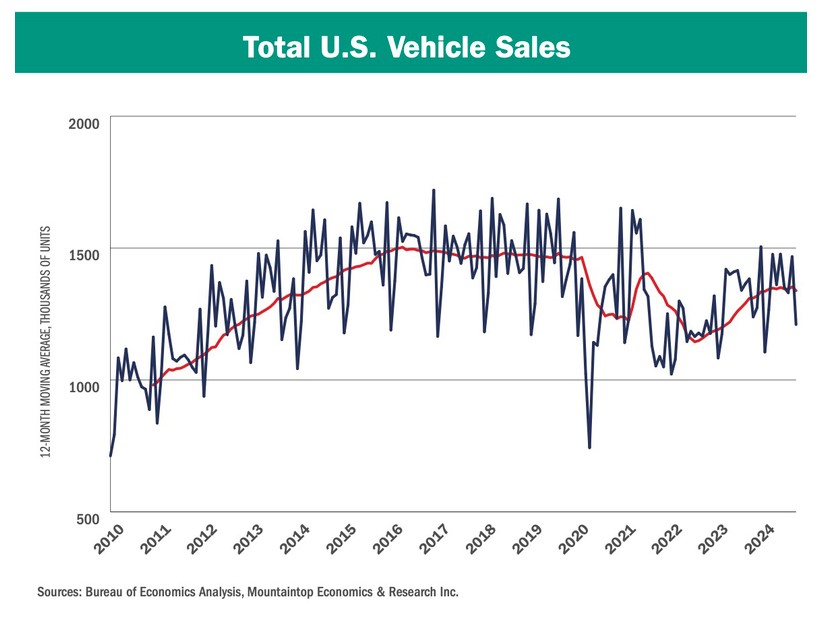

One of the indicators I am planning to monitor closely in the coming weeks for clues about the timing and the magnitude of the anticipated rise in demand for manufactured goods is total U.S. motor vehicle sales. I have three reasons for choosing this particular indicator.

First, the predominant trend in the motor vehicle industry is a bellwether for national economic trends, and it also affects a sizable portion of the plastics industry.

Second, demand for motor vehicles has historically demonstrated a strong connection to trends in the prevailing interest rates.

Finally, the recent trend in total vehicle sales over the past year or so corresponds very closely to the trends in most of the major indicators for the manufacturing sector.

On the chart, I have included two lines. One line is the graph of the raw, unadjusted monthly data for total motor vehicle sales in the U.S. This line exhibits a high degree of volatility from month to month, and it also exhibits strong seasonal factors. The smoother line is the 12-month moving average of the monthly data. This line shows the underlying, longer-term trend in the data without the seasonal fluctuations.

Looking first at the smoothed line, we can easily see that sales of motor vehicles have never recovered to pre-pandemic levels, and the average for the past year is about 7-8 percent below the average year prior to COVID. There was a substantial drop during the shutdown in the first half of 2020, but then the data suffered another precipitous decline in 2021 and 2022. Both of those declines have been well documented, and I do not have anything to add about them here.

The trend I am worried about, however, is the next one. For most of 2024, the underlying trend has been flat, and as I mentioned, this corresponds to the underlying trends in most of the other indicators from the manufacturing sector this year, including total output of plastics products.

Now despite last month's downtick in the data, I do not expect this graph to turn downward in the near future. But it is fair to say that it has not yet started to improve, and I cannot yet see any signs it will improve anytime soon. That is why I have included the graph of the unadjusted monthly data.

If you look closely at the data, you will notice that December is a big month for vehicle sales and that the December total is always followed by a weak month of January. That's the seasonality to which I referred earlier. This pattern is well established, and it will not surprise anyone.

But what I will want to see is just how high the monthly total goes in December compared with the previous year, and then just how low the total falls in January 2025 compared with the previous year. If the underlying trend is going to start rising, then we need to see monthly totals that are consistently higher than the previous year, and we need to see the majority of the monthly totals stay above the moving average line.

Now that the Fed is lowering interest rates, I would expect a sustained upward trajectory in the average line to start in the first half of next year. And if I am right, then the upcoming monthly totals from the fourth quarter of 2024 and the first quarter of 2025 will at least hold steady. Any obvious declines in the data in the next few months will be an indication that the underlying demand might be damaged more than we realize.

One crucial variable in the timing of the next recovery in this data will be the rate at which the Fed chooses to lower interest rates, and here some cause for concern has recently emerged. The latest employment report from the Bureau of Labor Statistics was stronger than anticipated, and the latest report on the Consumer Price Index was also hotter than expected. Neither of these data points increased enough to make the Fed change its decision about the future direction of its interest rate policy, but they may cause the Fed to slow its roll.

So for now, we remain in lag time. We think a recovery is coming, but it is certainly not here yet. Nobody knows for sure just how low interest rates need to go in order to get the manufacturing sector back on a growth track, and nobody knows when that will happen. All I can do is stay close to the data and report what I see. But like I say, sooner is better than later.

* Source : https://www.plasticsnews.com/news/when-will-economy-recover-its-manufacturing-sector

* Edit : HANDLER