German industrial sector signals hope amid inflationary pressures

main text

German industrial sector signals hope amid inflationary pressures

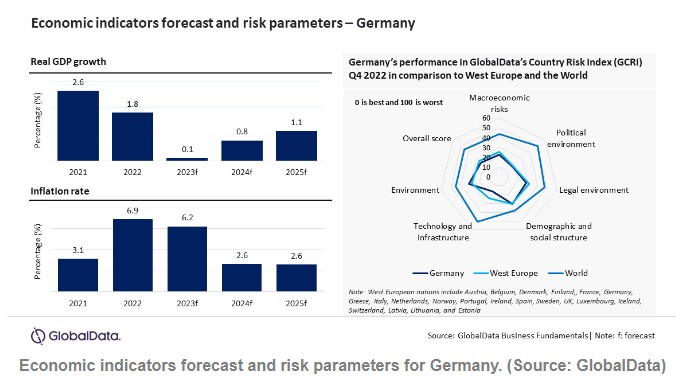

Despite persistent inflationary pressures still impacting the consumer spending and domestic demand, as well as the subdued outlook for external demand expected to further dampen trade prospects, the German economy will have a slight improvement with a projected real GDP growth of 0.8% in 2024, forecasts GlobalData.

The data and analytics company’s latest report, “Macroeconomic Outlook Report: Germany,” says that the imposition of sanctions on Russia severely affected the German economy, as it was the largest European buyer of Russian oil and gas, resulting in disruptions in the supply chain, high energy prices, increased construction costs, deteriorating financial conditions, and a decline in disposable income.

Germany's economic growth is significantly challenged by high inflation, which soared from 3.1% in 2021 to 6.9% in 2022. It is anticipated to remain elevated at 6.2% in 2023. In Q1 2023, Germany's real GDP growth remained stagnant following a revised 0.5% contraction in Q4 2022. Two out of the four quarters of 2022 saw a contraction in real GDP.

Sector-wise, financial intermediation, real estate, and business activities contributed 25.7% to the gross value added (GVA) in 2022, followed by the mining, manufacturing, and utilities (23.4%), and wholesale, retail trade and hotels (11.5%).

According to GlobalData, in nominal terms, the three sectors are forecast to grow by 4.8%, 4.8% and 5.4% in 2023, respectively, compared to 5.6%, 5.6%, and 6.3% in 2022.

On the external side, GlobalData projects German exports to experience a slower growth rate of 2.6% in 2023, in contrast to the average growth of 10.7% observed during 2021-22. Similarly, imports are also expected to grow at a slower pace of 5.6% in 2023, compared to an average of 14% over the past two years. This deceleration in imports can be attributed to currency depreciation and reduced disposable income.

Positive signs for the industrial sector

Germany's industrial output contracted by an average of 2.2% during March to July 2022 but recovered with an average growth rate of 1.2% from August to December 2022. In the first two months of 2023, it experienced a modest 0.5% increase.

The positive trend in the industrial output from August 2022 onwards and a significant growth of 4.8% in German industrial orders in February 2023, as reported by the federal statistics office, was influenced by the declining energy prices.

After the import ban on Russian oil in December 2022, the share of Russia oil in total oil imports of Germany plummeted from 36.5% in January 2022 to a mere 0.1% in January 2023. Germany successfully mitigated this decline by diversifying its oil imports from countries such as Norway, the UAE, the UK, the US, and Kazakhstan.

Sadaf Ambari, Economic Research Analyst at GlobalData, comments that Germany's shift towards renewable energy and diversification of oil imports has not only mitigated the impact of the ban on Russian oil imports but also sets a path toward a less fossil fuel-dependent economy.

“By prioritizing renewables and reducing bureaucratic obstacles in renewable energy production, Germany has the potential to build a sustainable and resilient energy sector for the future,” concludes Ambari.

It is also noteworthy that Germany's low-risk profile, ranking 12th out of 153 nations in the GlobalData Country Risk Index, reflects its resilience and stability amidst economic challenges. The country’s risk score is lower in the parameters of macroeconomics, political, legal, technology and infrastructure and legal risk when compared to the average of West European nations.

Source : https://www.adsalecprj.com/web/news/article_details?id=61855&lang=1

Edit : HANDLER