Machinery shipment values drop 24% in first quarter

main text

Machinery shipment values drop 24% in first quarter

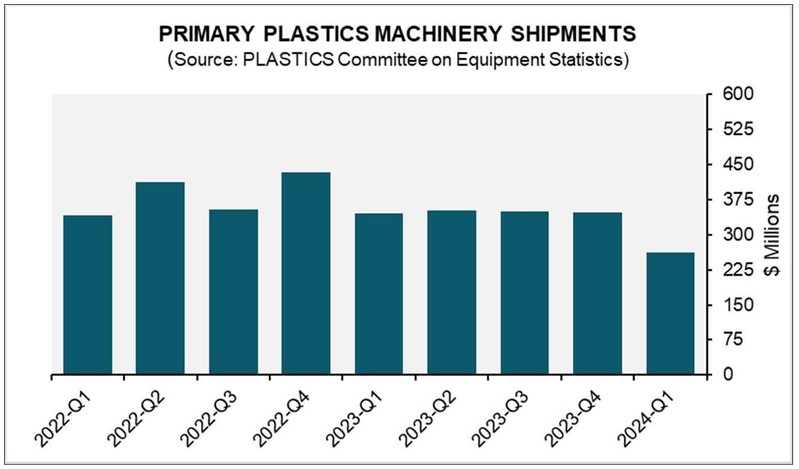

The double-digit decline in North American plastics machinery shipment values continued into 2024 for injection molding and extrusion equipment.

Initial estimates for the first quarter indicate a shipment value of $261.9 million, which is a 24.8 percent drop from the previous quarter and a 24.2 percent decrease from the prior year.

The figures, released May 20 by the Plastics Industry Association's Committee on Equipment Statistics (CES), are the latest in a "bad" string, according to Plastics News Economic Editor Bill Wood.

"I look at the trend in output of plastics products and the trend in the capacity utilization rate for the plastics industry. Both of those were bad," Wood said in a phone interview. "This is a tough environment to try to sell machinery."

High interest rates and geopolitical uncertainty continue to challenge plastics processors, and a new factor could be coming into play: criticism of plastics from shopping bags to bottles, containers and potable pipes.

"I really think this campaign against plastics is having a short-term effect," Wood said. "I think that it'll eventually turn around. You can't have a circular economy without plastic as the primary material, but it's having some impact right now while high interest rates have curtailed demand for some products like appliances and automobiles."

The CES reports that injection molding shipments fell by 33.8 percent between quarters while the year-over-year decline was 24.9 percent.

Single-screw extrusion saw the biggest decrease, 47.7 percent in quarter-over-quarter comparisons and a 23.4 percent decrease year-over-year.

For twin-screw extrusion, shipment values fell 7 percent from quarter to quarter and 17 percent from year to year.

Lower shipment values are common in the first quarter, Perc Pineda, chief economist at the Plastics Industry Association, a Washington-based trade group.

"Long-term data confirms this consistent pattern. Accounting for such seasonality, shipments decreased by 8.5 percent quarter-over-quarter," Pineda said in a news release. "This time, plastics machinery suppliers reacted in alignment with the overall pullback in the macroeconomy and a still high-interest-rate environment."

Wood agrees seasonality effects first quarter shipment values, but he said adjusting for it is massaging the numbers.

"The output of plastics is really only at the level it was in 2017. That's seven years ago. That's how much product total is being manufactured," Wood said. "You just don't need a lot of new machines with the industries not really going up."

Looking up

Still, economic outlooks seem to be going up.

The results of the latest CES quarterly survey indicate 74.4 percent of participants expect steady or improved market conditions over the next 12 months.

In addition, 48.9 percent of participants indicated an increase in quoting activity compared with 17.1 percent of participants in the previous survey.

"That's good to see and maybe things will be better with NPE orders," Wood said. "There has traditionally been an NPE effect on the data. I'm very interested to see that."

Wood said he is hesitant to predict what that effect could be, however.

"We haven't had an NPE for six years and that relationship was changing anyway from the old days," Wood said. "Certainly, you would think that when companies put a lot of effort into marketing products, they get some return on that investment. NPE is a giant marketing opportunity so you would expect a positive impact but I'm not going to predict."

While economic data shows consumers have jobs and money, Wood asks, "Are they choosing to spend it? Are they going to choose to spend it on plastics products?"

Another big question mark for Wood is the election between incumbent President Joe Biden and former President Donald Trump, who also is facing a myriad of criminal charges.

"The last time we had an election, some Americans stormed the capital. That had never happened. I have no idea what's going to happen this time," he said.

Exports down

As for the destinations of newly built machines, U.S. total exports of plastics equipment fell by 7.4 percent in Q1 2024 while imports are up 7 percent from the previous quarter.

Mexico and Canada remain the top export markets, accounting for $191.4 million in exports, which represents 47.9 percent of total U.S. plastics machinery exports globally.

"While still strong, the U.S. economy is poised for another year of growth, albeit at a slightly lower rate. However, growth in housing is hampered by higher borrowing costs, which also applies to higher capital expenditure financing in the business sector, including equipment investment in plastics manufacturing," Pineda said. "Manufacturing holds significant potential for growth, currently hindered by prolonged inventory adjustments and the rebalancing of consumption between goods and services."

The market has been tough for a while. North American plastics machinery shipment values plummeted in 2023 compared with 2022 for injection molding and extrusion equipment.

The values dropped not only in 2023's first quarter, which is typical, but barely budged the rest of the year and there was no fourth-quarter bump.

The fourth-quarter 2023 figure of $348.1 million reflected a 19.5 percent decline compared with the same period in 2022, according to the CES.

* Source : https://www.plasticsnews.com/news/machinery-shipment-values-drop-24-first-quarter

* Edit : HANDLER

- PreviousPE prices on the rise; buyers ‘very frustrated' 24.05.21

- NextMost commodity resins see hikes in March as PE stays flat 24.04.21