Chemical industry slides into summer lull as demand collapse persists

main text

Chemical industry slides into summer lull as demand collapse persists

According to Will Beacham, Deputy Editor, ICIS Chemical Business, chemical markets around the world are reeling from collapsed demand conditions in what would, traditionally, be the strongest quarter of the year for many markets.

Persistently high inflation is sucking money out of consumers’ pockets as wage increases have failed to keep pace with the rising cost of living. At the same time, central banks’ determination to bring inflation under control is driving them push up interest rates despite the current recessionary macroeconomic conditions.

Hopes were pinned on a post zero-COVID rebound in China. But that has failed to materialize as a construction sector bubble bursts, export markets stagnate and demographics drag on growth, stated Beacham.

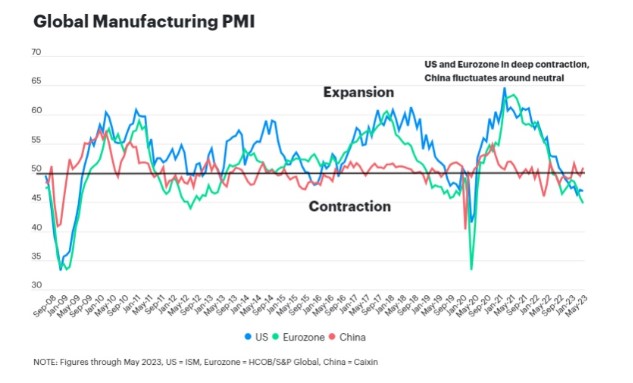

China is mired in a manufacturing recession with latest official purchasing manager (PMI) index May slipping further into contraction, though the private Caixan index suggested mild expansion. PMIs for Europe and the US are also in negative territory.

Demand has been falling since the second half of last year as Russia’s war in Ukraine disrupted global energy markets and pressurized the global economy just as a nascent post-pandemic recovery was getting underway.

Destocking has been underway throughout this year as customer sectors offload inventories they had built up when a “just in time” strategy gave way to “just in case.”

Poor demand across most sectors, regions

The lack of demand is being felt across almost all of the chemical groups and geographies which ICIS reports on. A new survey of all the ICIS news markets analysis published from 24-31 May shows that 47 out of the 48 articles published were negative on demand conditions, with one neutral.

The articles cover a wide range of chemical markets in Europe, North America, Asia and the Middle East. There are multiple reports of operating rate cuts, extended plant turnarounds, falling prices and poor margins.

The impact of poor demand and excess supply on chemical companies has been severe with many suffering steep falls in margins and profitability as Q4 2022 and Q1 2023 financial results demonstrated. Many market participants are now pinning their hopes on a rebound in 2024 as there are no signs of improvement for the second half of this year.

Overcapacity driven by China

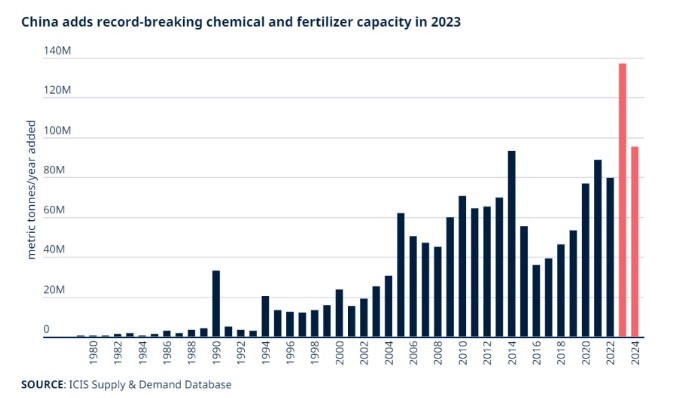

On the other side of the coin, supply is rising spectacularly in 2023 and 2024 driven by China. Since the financial crisis of 2008/9, China has embarked on a drive for self-sufficiency in petrochemicals, planning and building a massive wave of capacity expansions which will culminate in an astonishing 232.5m tonnes/year of new projects coming onstream in 2023 and 2024.

Speaking on the ICIS Think Tank podcast, ICIS senior consultant for Asia, John Richardson, said, “The pivotal change in China was 2014 when the government went for petrochemical self-sufficiency in a big way. In polyester fibers, polyethylene terephthalate (PET) film and bottle grade and purified terephthalate acid (PTA) China has gone from being the world's biggest net importer to the world's biggest net exporter.”

He added that China's net imports of polypropylene (PP) and styrene are likely to fall significantly this year.

Demographics dent demand

Aging populations dent demand for manufactured goods because older people spend less on big ticket items such as cars and electronics. Also speaking on the ICIS Think Tank podcast, Paul Hodges, chairman of New Normal Consulting, said, “The demographics are incredibly wrong, because if you take nine of the top ten economies in the world, the only growth in population now is in the low-spending over 55s. So you've built all this new capacity, but there isn't any demand for it.”

He believes that all the excess capacity being added in China and elsewhere will eventually lead to deflation. “Inflation is really causing a major cost of living increase but as and when the Ukraine war comes to an end, we will then pivot into major, long-lasting deflation because of so much oversupply.”

Longer term there are hopes that chemical industry growth may be driven more by the vast investments required along industrial value chains in the transition to net zero carbon. In that scenario the sector would no longer rely so heavily on the traditional economy to fuel its future.

Source : https://www.adsalecprj.com/web/news/article_details?id=62337&lang=1

Edit : HANDLER

- PreviousGerman industrial sector signals hope amid inflationary pressures 23.06.21

- Next▣ WOOJIN PLAIMM Newsletter for June [Vol.21] 23.06.11