Polyolefin pipes keep gaining market share, reports AMI

main text

Polyolefin pipes keep gaining market share, reports AMI

AMI, a leading provider of information, market intelligence and events for the global plastics industry, releases its recent report "Gravity Pipes European Market 2022".

It is stated that the European market for gravity pipes showed strong growth in 2018-2019, which was followed by a significant contraction in 2020 when COVID-19 began to take effect in the region.

In this extremely atypical year, the European economy saw a 6.3% decline in GDP in 2020. Construction activity was impacted initially but recovered in the second half of 2020 albeit suffered from supply-chain disruptions some of which continue into 2022.

The market for infrastructure pipes is reputed for its conservatism. AMI Consulting disagrees with such characterization. Admittedly, the market moves cautiously and gradually. But over the years, it has seen tremendous changes, which – despite the cautious, gradual adoption rates – can only be described as revolutionary.

While thermoplastics now command a high proportion of the small diameter gravity pipe market, there is still ample scope for growth through the substitution of traditional pipes systems in the larger diameter segment.

Growth opportunities exist in the further substitution of ‘traditional’ pipes (concrete and metal), as well as in the development and commercialization of new plastic-based systems, designed to provide better solutions (in terms of cost/performance) for modern-day needs.

Polyolefin pipes continue to gain market share from PVC and are forecast to experience the fastest growth rates, according to the report. However, PVC remains the predominant thermoplastic used for gravity pipes.

PVC though has been challenged in Europe for several decades on its environmental performance. Developments include the using of bio-based raw materials and the use in polymerization of green hydrogen. There have been several recent announcements of PVC with reduced carbon footprints and even some semi-tech production of PVC with a negative CO2 footprint.

PVC is also ahead of other polymers in Europe in measuring volumes of PVC recycled each year, setting and delivering ambitious future goals. Furthermore, it is claimed that PVC pipes can be recycled several times without loss of technical properties.

The use of recyclate is rising in many parts of the plastics industry. The need for high purity resins is the main barrier for increased use of recycled material to make pipes. Some pipes extruders have reported the usage of recyclate for gravity pipes.

However, the use of recycled plastics for gravity pipes could diminish due to the difficulty of obtaining good quality recycled material if other applications start using more recyclate. The industry is placing R&D efforts into circular solutions in order to manage portfolio proactively.

On the other hand, plastics pressure pipes are already positioned as more sustainable to non-thermoplastic materials, with life spans well over 50 years and a lower CO2 footprint.

The increase of heavy rains and the floods experienced by several European countries in last few years are forcing governments to increase budgets for water works and flood protection systems, increasing demand for larger diameter gravity pipes and pushing an early upgrade of the well-developed European gravity pipes network.

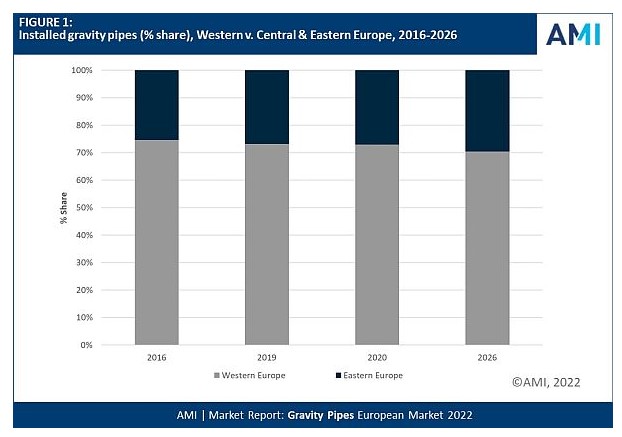

There are differences in growth in gravity pipe demand between the various European countries and regions. The report shows that the growth is focused on central and eastern Europe, where Poland had been the fastest-growing market in the review period. By 2026, the region is forecast to have grown to almost 30%.

The updated edition of the Plastic Gravity Pipes in Europe 2022 report forms part of a comprehensive series which further includes the Plastic Pressure Pipes in Europe 2022 and the Plastic Hot and Cold Water Pipes in Europe 2022.

Source : https://www.adsalecprj.com/en/news_show-77852.html

Edit : HANDLER