PP market ‘beginning to balance out'; PET only resin price to increase

main text

PP market ‘beginning to balance out'; PET only resin price to increase

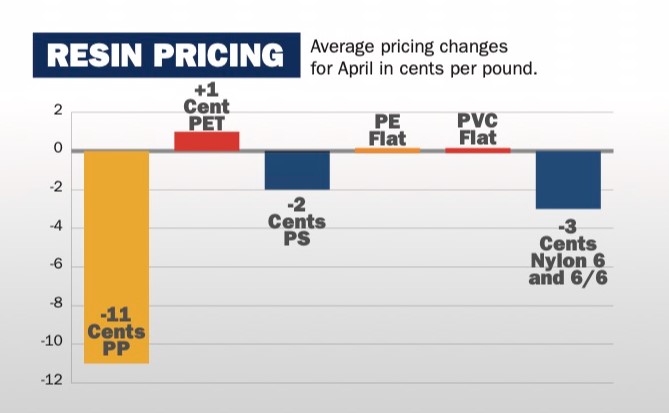

Two major commodity resins saw lower prices in North America in April, while one material saw a slight increase.

Polypropylene prices in the region dropped an average of 11 cents per pound in April. That price drop matched a drop seen in prices for polymer-grade propylene (PGP) feedstock. PP prices had been up 8 cents in March — again matching PGP — and up a total of 27 cents in the first three months of 2023.

The April price drop on both PP and PGP was anticipated by New York-based PP supplier Blue Clover LLC. In a market update, officials with the firm said they've seen less PP resin being offered into the market in late April compared with the end of March.

"This is a possible sign of the long market beginning to balance out," they added. "This balancing can still take several months, which is why we think its greater than 50-50 that PP pricing will slightly decrease in May, maybe 3-6 cents for prime."

Regional propylene supplies could be impacted by a recent fire at a refinery operated by Marathon Energy in Texas City, Texas.

North American PP supply was increased in mid-2022 when Heartland Polymers started production in Strathcona County, Alberta. Later in the year, the firm began making propylene monomer at a propane dehydrogenation plant at the site.

PS drops

Prices for all grades of polystyrene dropped an average of 2 cents per pound, essentially giving back a 2-cent increase that the market had seen in March. The April decrease was connected to slow demand growth and lower prices for benzene feedstock, according to market sources contacted by Plastics News.

Market prices for benzene, used to make styrene monomer, were down 17 cents to $3.60 per gallon in April. That represents a drop of 4.5 percent. Even with that decline, North American benzene prices are up a total of 53 cents so far in 2023. One source told PN that prices for both PS and benzene could increase in May, reversing direction once again.

In the global market, Trinseo has restarted the sales process for its styrenics business, changing strategy to include marketing individual assets and regional businesses included in that unit. During 2022, Wayne, Pa.-based Trinseo attempted to sell its styrenics business but ended those efforts in July because of unfavorable economic conditions.

PET up 1 cent

North American PET bottle resin prices ticked up an average of 1 cent per pound in April as a result of higher feedstock costs. Prices had been flat for two consecutive months after climbing 2 cents in January.

PET supplies will be affected by Alpek SAB de CV's recent decision to close its resin plant in Charleston, S.C. The site known as Cooper River was built in the early 1970s and has annual production capacity of about 375 million pounds.

PE, PVC flat

Prices for polyethylene and PVC resins were stable in April. PE prices closed flat after a lengthy battle in which producers tried to hammer through a 5-cent hike, but low demand eventually ended that effort.

Prices for all grades of high, low and linear low density PE had been up 3 cents in March, although that increase also was strongly resisted by buyers. Regional PE prices are up a net of 6 cents so far in 2023.

PE supplies in the region are being affected by Nova Chemicals' declaration of force majeure on PE resins made at its plants in Sarnia, Ontario.

Shell Chemical's massive new PE production units near Pittsburgh also are down after numerous issues with emissions. A company spokesman told PN that Shell "has encountered equipment issues, which have required maintenance in order to continue our ramp up of [the plant] safely and effectively."

In March, Shell confirmed "a significant delay" with reaching full production volume on one of the site's three PE resin units. The spokesman said "this [recent] constraint and ongoing work does not impact the operability of [the site's ethylene] cracker or the other two [PE] units."

Regional PVC prices were flat for the second consecutive month in April after moving up 1 cent in both January and February. Availability of PVC improved somewhat in April, even with construction industry buyers making purchases ahead of spring construction.

Market sources said short-term PVC availability could be impacted by a maintenance turnaround at Formosa Plastics Corp.'s PVC operations in Point Comfort, Texas. That work began in the first week of April and was expected to end in the first week of May.

Consulting firm Argus Media of London recently analyzed North American plastics data from the Global Trade Tracker data service. According to a research note posted by Argus, imports of plastic finished goods into the U.S. "have declined significantly" from a peak in the March-May 2022 time frame.

Nylon drops

In engineering resins markets, regional prices for nylon 6 and 6/6 resins fell an average of 3 cents per pound in April after dropping a total of 6-9 cents in the first quarter of the year. Larger-than-normal inventories at the processor level and sluggish demand were cited as reasons for the price declines.

"There's still too much [nylon] inventory out there," one source said. "People are still trying to figure out what normal inventory levels are after COVID."

The source added that although demand for nylon from the automotive market is "decent," demand isn't as good in nonautomotive uses.

In feedstocks, West Texas Intermediate oil prices opened April at $75.70 per barrel and ticked up 1.5 percent to $76.80 by the end of the month.

Markets for natural gas, a feedstock to make PE and PVC, have been lower than expected because of warmer winter weather, but they managed to increase in April. Prices for the material started the month at $2.22 per million British thermal units and ended at $2.41 for a gain of almost 9 percent.

Edit : HANDLER

- Previous▣ WOOJIN PLAIMM Newsletter for June [Vol.21] 23.06.11

- NextA load of latest plastics and rubber applications in automobiles 23.05.21