CPRJ Survey: 78% of respondents show optimism about 2023

main text

CPRJ Survey: 78% of respondents show optimism about 2023

In 2022, the COVID-19 pandemic and European energy crisis made impact on the globe and disrupted the global supply chain. Industries have been working to transform challenges into opportunities for growth.

Adsale Plastics Network (AdsaleCPRJ.com) has recently conducted an industry survey to see how the global plastics and major application industries perceive the market outlook and their expectations on 2023.

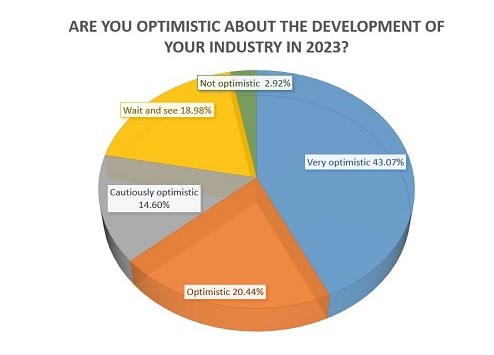

Among the 137 valid feedbacks, 78.1% of the total respondents are optimistic about 2023. In particular, 43.1% of the respondents are “very optimistic”, while “optimistic” and “cautiously optimistic” accounted for 20.4% and 14.6% respectively. 19% of the respondents picked the “wait and see” option and the rest is not optimistic (2.9%).

Plastics processing machinery

According to the survey results, 72.4% of the respondents from the plastics processing machinery industry showed their optimism about the industry development in 2023. More than a half of the respondents expected an over 20% YOY increase in their companies' turnover. Meanwhile, 93% of the respondents said that their companies have expansion plan for 2023.

When it comes to the company’s biggest concerns when purchasing materials or equipment for production advancement or expansion, “performance and reliability” ranked the top and followed by “costs”.

The most significant challenges the respondents see the industry is facing are supply chain disruption (48.3%) and surging energy prices (44.8%). Other challenges include rising logistics costs and the tightening of environmental regulations.

Chemicals and raw materials

72% of the respondents from the chemicals and raw materials field are optimistic about 2023, while 24% stated that they prefer “wait and see”. 80% of the respondents anticipate increase in turnover for their companies.

Supply chain disruption (40%) is again the main challenge the industry is facing. Rising logistics costs (24%) and surging energy prices (20%) are also bottlenecks for growth, the survey finds.

68% of the respondents shared that their companies have expansion plan for 2023. Considering the regional markets that the company will focus on exploring in 2023, it is noteworthy that South East Asia accounted for 24% and India accounted for 20%.

Automotive parts / Car making

In the automotive parts/car making industry, 85.7% of the respondents feel optimistic about 2023. 72% of these respondents are “very optimistic”. 33.3% stated that they forecast a more than 20% YOY increase in their companies’ turnover.

Nonetheless, 47.6% of the respondents reported that supply chain disruption is the main challenge that the industry is facing. Reduced car consumption (33.3%) and economic downturn (33.3%) are their concerns as well.

Supply chain disruption, reduced car consumption, and economic downturn are the current concerns of the automotive industry, according to the CPRJ Industry Survey 2003.

In order to restructure and manage the supply chain this year, 38.1% of the respondents said that their companies will improve the flexibility and responsiveness of different production bases. Accurately controlling inventory (28.6%) and aligning production cycles with market trends (23.8%) are other common measures.

The automotive parts/car making industry is working on cost reduction and efficiency increase. Here, energy-saving equipment, lightweighting technology and plastics laser welding process are gaining their attention.

Medical devices / Medical packaging

Respondents from the medical devices/medical packaging industries are rather cautious when compared to the other industries, as 40% of them took a “wait and see” attitude toward the industry development in 2023. Yet still, 60% of the respondents expected increased turnover for their companies.

In their viewpoint, In Vitro Diagnostic (IVD) medical device (40%), low value consumable (33.3%) and household medical device (33.3%) will have high growth potential.

Apart from supply chain disruption (60%), cost pressure brought by centralized procurement (20%) and complexity of healthcare regulations (20%) are major challenges in the industries.

Plastic packaging

72.4% of the respondents in the fields of plastic packaging for daily chemical, cosmetic, personal care and food & beverage are optimistic, while 24.1% of the respondents are sitting on the fence. 47.6% of respondents believe that their companies’ turnover will realize a more than 20% YOY growth, and 38.1% of the respondents expected a less than 10% increase.

About half of the respondents in the packaging industry believe that their companies’ turnover will increase more than 20%, the CPRJ Industry Survey 2003 finds.

Fluctuating raw material prices (55.2%), supply chain disruption (24.1%) and high costs for transformation to sustainability (20.7%) are bigger challenges among all.

Furthermore, recyclable & recycled materials (34.5%), bioplastics (24.1%) and degradable plastics (20.7%) will catch the companies’ attention in 2023. And they consider purchasing processing equipment like recycling equipment (34.5%), mold/hot runner (17.3%) and extrusion equipment (13.8%).

Moreover, the respondents think that cost reduction will be more important (41.4%) in 2023, while recycling will play a more important role (27.6%) and there will be higher demand for innovation (27.6%).

Consumer electronics / Home appliances

43.5% of the respondents in the consumer electronics/home appliances industries said that they are “very optimistic” about 2023. Most of the respondents (82.6%) forecast increased turnover for the company.

Regarding the expected best-selling products in 2023, small personal care appliance (43.5%) topped the list, followed by small kitchen appliance (34.8%).

Besies, the companies are more interested in technologies of multi-color and multi-material injection molding (34.8%), 3D printing (21.7%), electromagnetic dynamic injection molding (17.4%) and surface treatment (17.4%).

Source : https://www.adsalecprj.com/web/news/article_details?id=60241&lang=1

Edit : HANDLER

- PreviousWoojin Plaimm in BUTECH 2023 (Busan, South Korea) 23.04.19

- NextCompetition to heat up over recycled PET supply 23.03.19