Press makers cite midyear slowdown, remain hopeful for 2023

main text

Press makers cite midyear slowdown, remain hopeful for 2023

Injection molding machine sales started the year on a high note with momentum from an exceptional 2021 continuing to buoy capital investments by plastics processors.

Press producers sold an estimated 5,000 units last year, which was an increase of 25 percent from the 4,000 presses sold in 2020. For a few months, it looked like 2022 could be a repeat. However, the second half of 2022 brought a marked change.

Engel North America in York, Pa., has seen a decline in incoming orders since August, according to Stefan Engleder, CEO of parent company Engel Austria GmbH.

"This is mainly attributed to the construction and infrastructure industries. Compared with this, automotive is still performing well globally. Engel is gearing up for a further decline in demand, although we are optimistic for the medium- and long-term outlook. Plastic processing remains a growth market," Engleder said in an email.

Injection molding machine builders expect a 10-20 percent drop in units shipped in 2022. Several cited the midpoint of 15 percent, which would be a decrease of 750 molding machines to an estimated 4,250 units for the year.

The estimate is based on Plastics News industry interviews and story archives. The Plastics Industry Association trade group crunches other data about North American machine shipments but only shares it with its paid members.

The trade group did report that shipments of primary plastics machinery for injection molding and extrusion slowed in North America in the third quarter. The preliminary estimate of shipment value from reporting companies totaled $353.8 million, which was a decrease of 14.4 percent from the previous quarter but an estimated increase of 6 percent from a year earlier.

Also, historically, there is a bump up in shipments in the fourth quarter.

To date, 2022 was strong to the middle of the year then also slowed for Rocky Hill, Conn.-based Arburg Inc., a subsidiary of Germany's Arburg GmbH + Co KG.

"As the COVID crisis has subsided, many companies — especially in medical — have found that production capacity that they built up in 2020 and 2021 can be reallocated," Arburg Inc. President Friedrich Kanz said. "So, there is now a certain consolidation going on, and sales volumes are returning to more normal levels."

Overall, the market is still very active and the plastics industry is in good shape, Kanz added.

At Absolute Haitian, sales are more in line with 2019 or 2020 than the record year the company enjoyed in 2021.

"This should be similar for many injection molding machine manufacturers in the U.S.," said Glenn Frohring, an owner of the Worcester, Mass.-based company that sells injection molding presses made in China by Haitian Plastics Machinery Ltd.

Haitian, the world's largest press builder, reported in March that it sold more than 56,000 machines in 2021. Sales climbed 35.7 percent to a record $2.5 billion following strong global demand in the first half of the year and stability in the second half.

Last year also brought a record new order rate for Wittmann USA Inc., formerly Wittmann Battenfeld Inc., in Torrington, Conn., and the machine builder is sitting on a record order backlog, according to President David Preusse.

But, unlike 2021, this year has not been strong and stable.

"As is the case with many global markets, the U.S. plastics industry is recording a 15- to 20-plus percent reduction of new orders in 2022," Preusse said. "Many shipments pushed over to this year, so revenues are still okay, just impacted for supply chain delays."

At Boy Machines Inc. in Exton, Pa., sales have slowed down by about 20 percent, President Marko Koorneef said.

Meanwhile, at Batesville, Ind.-based Hillenbrand Inc., sales for the Molding Technology Solutions business unit, which includes plastics machinery manufacturer Milacron, increased 6 percent to $276 million compared with last year. The increase was driven by higher volume and higher prices. However, order volume slowed in the fourth quarter due to delays in customer decisions.

"Our Molding Technology Solutions segment had annual revenue and margin expansion that came in near the high end of our expectations. And while we did see a slowdown in orders in the fourth quarter, largely due to the rise in global macro uncertainty, we are entering fiscal 2023 with a strong backlog," CEO Kim Ryan said in a Nov. 17 quarterly call.

Tony Marchelletta, national sales manager for Sumitomo (SHI) Demag, said, "The overall IMM market is definitely declining. However, we're fortunate to be aligned with customers and markets that are not easily impacted by the current economic challenges. Current projects and demand from newer projects have remained steady year over year."

LS Mtron machine shipments to the U.S. "remain steady and similar to 2021," according to Peter Gardner, business director of LS Mtron Injection Molding Machine USA.

At Nissei America Inc. in San Antonio, sales were up 3 percent on a unit base and 15 percent on a dollar base, according to President Junichi Kubota.

"We have been keeping up with this high pace," Kubota added.

At Krauss-Maffei Corp. in Florence, Ky., Sales Director Martin Stojkovic said he has seen "a steady increase in growth" with the hottest markets being logistics, packaging and medical.

In Elk Grove Village, Ill., at Plustech Inc., the North American base of Sodick Co. Ltd.'s injection molding machinery division, National Sales Manager Len Hampton said the businesses experienced record sales the last two years and 2022 is poised to top those numbers.

"We're going to finish strong," Hampton said. "This could ultimately mean there may be a problem for the industry in a few years with all those machines out there."

Showing strength

Plustech has seen a big uptick in orders from customers manufacturing products and components for medical devices and electronics, especially related to connectors for personal electronics. "High-temperature, engineering-grade materials are a great fit for Sodick technology, and these markets drive demand," Hampton said.

The medical market is the strongest for Boy in the U.S. "COVID is the main factor," Koorneef said.

At Nissei America, which celebrated its 45th anniversary, Kubota also said the medical market was the strongest and pointed to the pandemic.

"Machine sales to irrigation industry has been also steady," Kubota said.

Sumitomo (SHI) Demag's strongest markets continue to be consumer packaging and medical. While products and needs have evolved post-pandemic, Marchelletta said both have remained strong.

"Medical is trending away from pandemic-related products, back to a more normal mix of devices and disposables. The aging U.S. population continues to drive new developments that require single-use drug delivery, at-home health care and other diagnostic and treatment products," Marchelletta said.

The consumer packaging market has seen similar adjustments.

"During the pandemic, there was much focus on single-use, necessity items such as standard caps and cutlery. The new trend is back to higher-end, brand-specific packaging. This is driving some major investments in equipment," Marchelletta said.

At Krauss-Maffei, Stojkovic singled out the logistics, packaging and the medical markets as strong in calendar year 2022 with the automotive segment looking better.

"Also, with so many people still working from home, the home improvement product market continues to remain strong," Stojkovic said.

LS Mtron's strongest markets in 2022 have been logistics packaging, such as totes and containers, and automotive molding, driven largely by U.S. suppliers to Hyundai and Kia and the beginnings of EV battery production programs.

"Appliances and electronics follow closely due to robust machine sales to those manufacturers, including LS Mtron's founding company, LG Electronics," Gardner said.

At Absolute Haitian, Frohring said the packaging and consumer products markets picked up during the pandemic and stayed strong in 2022.

"While many people were remotely working from home, they had time to clean out attics, update living spaces and convert living spaces to work-at-home spaces," Frohring said.

The manufacturers of these packing and consumer products replaced older, inefficient machines with newer energy-saving platforms like the servo-hydraulic MARS 3 and electric ZERES 3.

"Our third-generation models introduced in 2021 were very well received and sold strong in 2022," Frohring said.

Overall, Engel North America performed very well in 2022, Engleder said, with the packaging division in particular growing significantly.

"All told, Engel is benefiting from the ongoing reshoring trend in this region," he added. "The response by Engel to the very high demand for machines with short lead times in North America is the stock machine program we have been extending year by year; this strategy has helped Engel win over many projects."

Even after the COVID rush has calmed, the medical market continues to develop for Engel. Engleder pointed to products related to autoinjectors and inhalers.

The automotive sector also recovered faster than expected for Engel in fiscal year 2021-22 and still accounts for a high share of order intake, Engleder said.

"Electric mobility and autonomous driving require new technologies, most of them based on plastic materials," he said. "Another driver is the modernization of machinery to boost energy efficiency. In the automotive industry, the carbon footprint plays an increasingly important role."

At Wittmann, medical market demand has switched from pandemic-related needs to products that serve the growing aging population, while consumer goods stayed strong and new interest came from the automotive market.

"We started seeing automotive asking about more automation, since robots don't get COVID or exposures," Preusse said. "But unfortunately, the anticipated auto sector demand rose, but not manufacturing output. They, too, were stalled from critical parts shortages, hence high demand, lower output."

Marco Stepniak

Supply chain kinks

Everything from raw materials to hoses and fittings to microchips continue to challenge many machine builders in terms of increased prices and delays.

"The situation in materials procurement has eased slightly but remains critical. We are still doing everything possible to cushion the effects of the bottlenecks," Engleder said. "This is helped by our multisourcing strategy, the good relationships with our suppliers with whom we align on a daily basis and strategic investments to meet our supply obligations. With this strategy, we were consistently able to deliver and lessen major delivery delays."

All companies have had to make some adjustments, Marchelletta said, noting Sumitomo (SHI) Demag developed multiple supply chains to support its manufacturing facilities in Germany, Japan and China and is part of the vertically integrated Sumitomo Heavy Industries group.

"As for microchips specifically, we have found solutions," Marchelletta said. "Newer control models do not seem to be as affected as those that are 10-plus years old. For the older models, we've found suitable replacements, upgrades or offer rebuild services for our customers. This is something we faced with our legacy fleet for many years."

At Sodick, Hampton said microchips aren't a problem like other components.

"We manage our supplies and raw materials, but hoses, fittings and electrical controls have been more difficult, and we're ordering more now than ever," Hampton said.

LS Mtron has been able to isolate itself from major disruptions so far, thanks in part to the family of LG- and LS-founded companies in its supply chain. For example, the South Korean steel castings come from an LS-founded steel foundry, Casco; servo motors and systems come from Higen, an LG-founded company; and many electrical components come from a sister company, LS Electric.

"And finally, for logistics, LG spinoff LX Pantos is one of the world's largest shipping lines," Gardner said. "Our deep relationships with these suppliers — and buying power as one of Korea's largest conglomerates — has kept our production line running well. We can build a 1,000-ton machine, from castings to cargo, in about 100 days."

Frohring said Absolute Haitian also has cleared its hurdles.

"Any supply chain issue has been mitigated with alternatives identified and quickly sourced," Frohring said.

Arburg officials said the company was able to avoid supply chain problems thanks to long-standing partnerships with predominantly local suppliers and a high level of vertical integration.

At Krauss-Maffei, Stojkovic said some machine components are hard to come by with the supply chain problems, "but we've put several plans in place to mitigate the effects of customer commitments and machine deliveries."

Logistical glitches

Even though LS Mtron can go from a machine casting to machine cargo in about 100 days, the timeline can get tricky after that.

"The widely reported delays at U.S. ports, caused by congestion, were real, and we did face challenges to get our machines off the ships and on to their final destinations," Gardner said. "It does seem to be freeing up now."

Krauss-Maffei's Stojkovic said there are fewer freight lines crossing the ocean, and shipping companies have reduced the number of port of entries.

In the case of ocean freight, Marchelletta said some routes had gone from three weeks out to more than two months.

"This has caused us to proactively forecast for our customer's needs and increase our local stock position to ensure we can meet their demands," he said. "In addition to freight, all travel- and logistical-related costs are dramatically increasing. This not only impacts machine shipments but travel for our service and support staff members."

At Boy, Koorneef said he has seen a slight improvement in sea freight and truck shipments in recent months, "but the situation is still difficult to handle" in terms of longer lead times and price increases. "We see a trend from customers to stack and combine shipments to reduce the number of pick-ups," Koorneef said.

Hampton said logistical challenges have improved but at a price. "It's getting better, but freight costs for getting machines from Japan to U.S. is obviously more costly. Ocean freight and inland freight can be five times what it used to be," he said.

Preusse summed up the situation this way: "It's no secret the over-demand economy put the global supply chains into total chaos and disruption, which has led to inflation. Logistics have seen record inflation."

At Billion Plastics Machinery Inc. in Rochester Hills, Mich., North American Sales Manager Georg Kiesl said transportation costs have been rising due to increased fuel and maintenance costs. "The continued shortage of trucks and truckers in parts of North America has also had an impact on availability and reliability of road transportation," he added.

Frohring said sea freight has stabilized but trucking problems persist.

"We have strong relationships with often-used trucking companies to offset this," he added. "Regarding fuel costs, we have experienced the impact of higher fuel costs."

Overall, Absolute Haitian machines are getting built and delivered without problem, Frohring said.

"Haitian does not have this issue because of the high level of capacity and volume of machines sold around the world. We can maintain a healthy supply of stock machines," Frohring said. "Plus, suppliers tend to prioritize us due to our volume, helping to mitigate delivery of components."

Sumitomo (SHI) Demag has made a major investment over the last two years in its inventory of stock machines with modification capabilities.

"Instead of waiting on a long delivery, directly from the factory, many times we have a suitable machine that is in process or on our floor in the U.S.," Marchelletta said. "Since we have good relationships and control of our supply chain, coupled with the ability to produce globally, we have not been impacted as dramatically as some. However, there continues to be variables and uncertainty in shipping lanes that have caused delays. Nothing that we can't overcome with our combined strategy of offering built-to-order and stock/inventory solutions."

Nissei America can ship as quickly as eight to 12 weeks, depending on the machine specifications, Kubota said.

Billion also is able to honor its standard lead times of around three to four months, Kiesl said.

However, for machines with customized equipment, Koorneef said the lead times can be up to a year.

Shoring up

Logistical problems are behind recent reshoring projects, according to some machine builders, while others say there is more talk than action.

"Absolutely, there is a movement to reshore in North America," Sumitomo (SHI) Demag's Marchelletta said. "We first saw it just before the pandemic as pro-manufacturing policies and tax incentives were put in place. It was then accelerated during the pandemic, especially in the areas of medical and consumer markets that struggled to get critical products from offshore. This continues to expand into more technical markets, such as electronics."

At Krauss-Maffei, Stojkovic agreed.

"Reshoring is taking place and will continue to do so across all markets, especially with electronic parts and microchips," he said.

LS Mtron has been equipping new U.S. medical molders and manufacturers of products for home improvement and organization. "Reshoring of these types of products continues, and for those concerned about the stability of the U.S.-China relationship, alternative supply chains such as South Korea and others are highly attractive," Gardner said. "LS machines made in South Korea seem to fit the mold for companies seeking to reshore and diversify their supply chains."

The challenges of overseas business trips and international shipping have prompted some of the reshoring, Absolute Haitian's Frohring said.

"It is related to the restrictions of visiting the supply partners in China and the desire to have contingencies that will counteract logistical delays and costs due to the period where container prices were extremely high and delivery times from overseas suppliers were long," Frohring said. "Much of this was due to poor management of West Coast ports, overwhelming volume and poorly thought-out regulations."

Imported goods from China are especially vulnerable as the U.S. maintains its reshoring momentum and rebuilds its industrial base, according to Harry Moser, president and founder of the nonprofit Reshoring Initiative.

The stage is set for a manufacturing resurgence in which $4.6 trillion of exports could shift to regional sources worldwide by 2030, Moser said in an email, pointing to a report by McKinsey & Co., a consultancy firm founded in Chicago in 1926.

Moser, the former president of machine tool maker GF AgieCharmilles and 1996 SPE Mold Designer of the Year, sees opportunities for a variety of products to be reshored.

"Products sourced in China today come to mind," Moser said, "and also products where the U.S. isn't self-sufficient, like PPE [personal protective equipment], pharma, EV batteries; products with high freight vs. labor content; and production that is automatable, fairly energy-intense and where U.S. raw material cost is competitive. Plastic products fit most of those categories well."

In 2021, the push for domestic supply of essential goods propelled reshoring and foreign direct investment (FDI) job announcements to a record high of 260,000, according to the Reshoring Initiative. Data from the first half of 2022 shows more gains. The number of job announcements is expected to reach 348,500 by the end of the year.

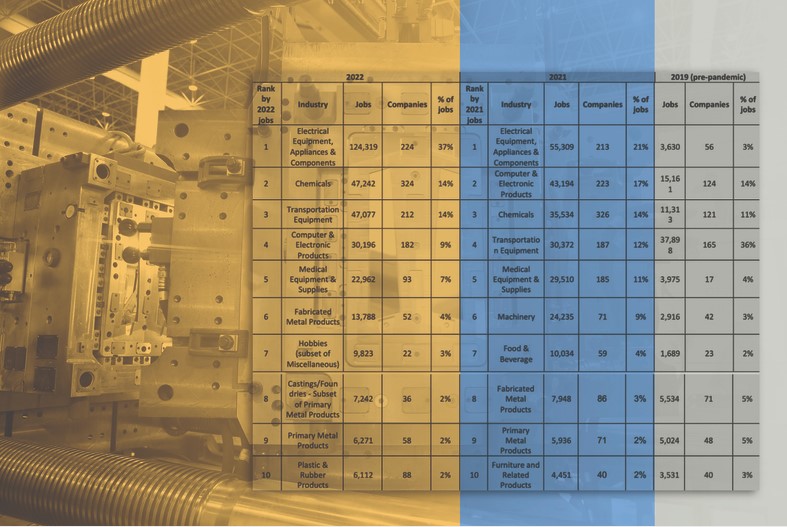

For the first half of 2022, 6,112 jobs were reshored for manufacturing plastic and rubber products, which ranks 10th among 16 categories tracked by the Reshoring Initiative.

"We try, not always successfully, to put plastic components in a category with rubber products. Many plastic components are reshored to produce transportation equipment, EV batteries, PPE, etc., and are in other categories," Moser said.

In the top 10

The number of jobs created to produce electrical equipment, appliances and components topped the list for a second year. Electric vehicle batteries are in this category, which usurped the No. 1 ranking from transportation equipment, even though it still applies to the transportation industry.

Electrical equipment's share of jobs announced went from 3 percent in 2019 to a projected 37 percent in 2022.

The second-largest industry to reshore jobs is the chemicals category, driven by pharmaceuticals, particularly the need for vaccines and COVID-19 treatments, but also by renewable fuels and plastic materials. The chemicals category moved up a notch from the third spot in 2021.

"The biggest trend has been the production of polyethylene, polypropylene and plastic resin," Moser said. "Driven initially by fracking, now it's driven by Russia-Ukraine making the U.S. very attractive vs. Europe."

The Russia-Ukraine war is driving up energy costs in Europe, while the U.S. has relatively stable prices and green energy incentives that are luring companies.

"Some EU companies are saying that the USA is a safer place this winter, so we may get some reshoring, however, wage inflation may redirect spending for new plants in Mexico, as before [former President Donald] Trump curbed that migration in his trade war," Preusse said.

Marchelletta agreed, pointing to other factors that could make near-shoring more attractive than moving a company to the U.S.

"Our market is facing several hurdles such as rising wages, skilled labor shortages and pending tax penalties. Many companies are considering other sites on our continent, such as Mexico and Central America," he said.

Arburg's Kanz holds a similar view.

"Whether you look at reshoring or at companies retaining production in North America, this is an ongoing process, and it will continue," he said. "The big question is if there will be enough labor to support it — and we may see work going to Mexico instead — but it is still a trend that will continue. It is an interesting process, and it will benefit the entire North American plastics industry in 2023 and for years to come."

After the chemicals category, transportation equipment ranks third for reshored jobs, followed by computer and electronic products, which has been pushed in recent years by solar panels, robotics, drones and semiconductors.

The other top 10 categories are medical equipment and supplies, fabricated metal products, hobbies, castings, primary metal products, and then plastic and rubber products.

War-time considerations

Russia launched a military attack on neighboring Ukraine on Feb. 24, bringing worries of war casualties, a refugee crisis, grain shortages, sanctions, nuclear threats and more to a world two years into a pandemic.

Global commodity prices skyrocketed, particularly for natural gas, wheat, fertilizers, metals and minerals. The supply chain kinked up more and new geopolitical tensions arose.

"Undeniably, the ongoing conflict has been a strong driver of global raw material and energy prices," Kiesl said.

Krauss-Maffei's Stojkovic put it this way: "The war in the Ukraine has been another drain on our supply chain and has made it even more difficult to receive parts in a timely manner for production of machinery."

Also, determining the extent of the impact on processors' machine needs is difficult, Boy's Koorneef said.

"Several East European partners have canceled or postponed projects in connection with Russia," he said. "At the same time, others are bringing back the production to Europe for more reliability in their supply chain."

Frohring also said some plastics processors located near the conflict shifted production. However, he added, "The major impact to our customers seems to have been the higher energy costs to produce and ship and less money to spend on equipment."

Some plastics processors are shifting production all the way to North America or investing mainly in all-electric presses, which generally use less energy than hydraulic and hybrid machines.

Marchelletta pointed to Sumitomo (SHI) Demag customers with a strong presence in Europe.

"They are much more concerned now with reducing energy consumption of their production with our all-electric products. This was an immediate reaction to the sharp increase in energy prices in Europe," he said. "For fleets that have a large number of hydraulic machines, many are using this as an opportunity to replace those units with all-electric machines. Others are choosing to offshore away from Europe. This has led to sudden demands in North America as production gets relocated."

Russian President Vladimir Putin is under pressure to withdraw from Ukraine and end the "special military operation." An estimated 100,000 Russian and 100,000 Ukrainian soldiers were killed or injured by early November.

Putin also has been accused of weaponizing food and energy by blocking grain shipments to developing countries and cutting gas flows to the European Union. As EU governments turned to other gas and oil suppliers, global prices moved up from the increased demand.

"Putin's war includes an energy war, and most global markets move together, so while the EU is going to be in worse shape come winter, we all feel the threats," Preusse said. "Much of the world didn't know some of the critical items that come from Ukraine like grain until the war suspended them."

The war also is raising questions about nations that have remained neutral, such as China and India.

"I hate to say it, but China's support of Russia has caused certain customers to consider alternative supply chains," Gardner said. "Korean and European suppliers are surely a beneficiary of the increased concerns about the U.S.-China relationship, but I think we all would rather trade any increase in business opportunity for peace in Ukraine."

Inflation, interest rate woes

Inflation and higher interest rates also are factors for some machine buyers.

"It certainly is impacting our North American and global markets," Marchelletta said. "It is easy to see from our most recent … plastics industry data that new injection molding machine consumption is significantly down for our market."

Even so, converters are still buying Sumitomo (SHI) Demag equipment and planning for significant future replacements and growth, Marchelletta said.

"We remain optimistic," he added. "We've spoken to some customers that were planning for 20-plus replacement units in the next year that have changed their timing or only reduced the number, not completely abandoned the projects."

Boy staff hasn't noticed any changes related to inflation or higher interest rates — yet.

"We feel that a lot of customer projects have been held up by COVID and now had to be executed to move forward," Koorneef said. "But the longer the inflation continues, the more it will have an impact on new projects. Higher interest rates will make it more difficult for customers to find financing."

Hampton said customers that buy Sodick machines aren't typically financing, so interest rates aren't an issue.

"If the work is there, customers will do what's necessary to secure the equipment and get the orders out," Hampton said.

At LS Mtron, Gardner said inflation could become a factor, but "so far the strong dollar in relation to the Korean won has actually allowed us to keep our sales price in check; we have not seen any negative influence so far — fingers crossed!"

Krauss-Maffei's Stojkovic agreed.

"In some form or fashion, it must play a factor; however, the books are full, and the projects keep coming despite the high inflation."

With all the talk about inflation and a possible recession, Arburg's Kanz said, "I don't think we will have a booming year next year. But it will be steady, and I believe the American plastics industry is in good shape and may get stronger. The U.S. is in a much better situation than Europe, where energy costs are way up."

Preusse said, "Time will tell what kind of recession may be ahead. We easily have over six months' backlog and more new projects coming, but obviously the Fed is raising rates to cool the economy that, frankly, the government inspired in epic stimulus money north of $6 trillion."

Technological advances

With 2022 being a K show year, injection molding machine builders presented many new technologies and solutions.

Engel's new two-stage process to recycle plastic waste directly like flakes got a lot of attention in Düsseldorf, Germany.

"Until now, shredded plastic waste for injection molding processing first had to be melted and regranulated. This process is energy-intensive and correspondingly expensive," Engleder said. "With the new two-stage process, this work step can be completely eliminated, which massively increases the cost efficiency of recycling. Ecology only goes with economy; we at Engel always keep this in mind in all our development activities."

Nissei America launched a low-floor-type vertical machine, while Wittmann showed processors how to modernize manufacturing plants.

"The ongoing exploration into smart factories, Industry 4.0 and digitalization is drawing more clients toward Wittmann, since we lead in total cell integration, since we are virtually alone in offering all the processor needs made by and integrated by us," Preusse said.

Sumitomo (SHI) Demag expanded all-electric offerings in key areas in response to customer requests, according to Marchelletta.

"Our medical molders' need of a flexible platform for LSR/LIM molding has led to a release of all-electric models capable of integrated LIM solutions," he said. "Higher-performance injection requirements have led to the release of our SHR (superhigh response) injection. In general, customers are wanting more integrated and networked solutions. Our IntElect2 models are well equipped to address these networking requirements."

Frohring said technology advances are refining the Internet of Things and Industry 4.0 connectivity and protocols.

"This is settling out and becoming more accessible across industry platforms," he added.

Kanz also said the digital products being rolled out on a regular basis are significant.

"Those that Arburg has introduced in the last couple of years are receiving positive feedback from customers," he added. "I think I can safely say that all the different digital products — remote service, for instance — are very well received by our customers."

Sodick's focus on making its machines modular resonates with processors, according to Hampton. "It's been a definite trend to have big molds with a lot of action in the tooling, shooting very small shot sizes, of 2-3 grams. That's Sodick's sweet spot, and it's really boosting sales," he said.

Energy efficiency has been a hot topic for Boy staff.

"The already low energy requirements of our machines have been a major sales factor and have become more and more important since the energy crisis in Europe has been picking up speed," Koorneef said.

Billion rolled out another size of its full-electric SELECT² series with the launch of a 150-ton press. The second-generation machine features an integrated indexing arm system.

LS Mtron added Mucell microcellular foam capabilities to its lineup, launched AI features for its machinery and introduced a new high cycle line of all-electric presses.

Krauss-Maffei rounded out its data solutions lineup with products for a smart assistant, condition monitoring, remote diagnostics, troubleshooting and more.

The machine builder also presented 3D printers for industrial applications at K 2022. Additive manufacturing will form the fourth pillar of the Krauss-Maffei product portfolio along with injection molding, extrusion and reaction process machinery.

Adding, replacing capacity

Plastic processors are becoming more cautious and waiting longer to place machine orders, often until they have production orders in hand.

"This has driven our stocking/inventory program in close communication with our top customers so that we are equipped to support last-minute machine needs," Marchelletta said.

He puts Sumitomo (SHI) Demag machine orders for new projects vs. replacement at an even split. "Some of our customers realize that to be competitive, they must rid themselves of older, less-efficient, lower-precision equipment and replace it with the latest technology," Marchelletta said.

The Boy sales team has seen an increase in machine replacement. Koorneef said the replacement market is 30-40 percent of business.

For Sodick, Hampton said about 70 percent of machine buyers are adding capacity for existing jobs and 30 percent for new applications.

At Krauss-Maffei, Stojkovic said customers are adding machinery and not replacing due to significant increases in utilization.

Frohring said replacement machine opportunities continue to grow.

- PreviousDigital transformation spending up 16% YOY to US$1.85 trn in 2022 22.12.21

- NextMedical device packaging market to grow at CAGR of 10.16% 22.12.21